공유하기

[SEOUL G20 BUSINESS SUMMIT]Competing in the Arena of Business, B20 Global Players are Top of Game

- 동아일보

-

입력 2010년 11월 11일 03시 00분

글자크기 설정

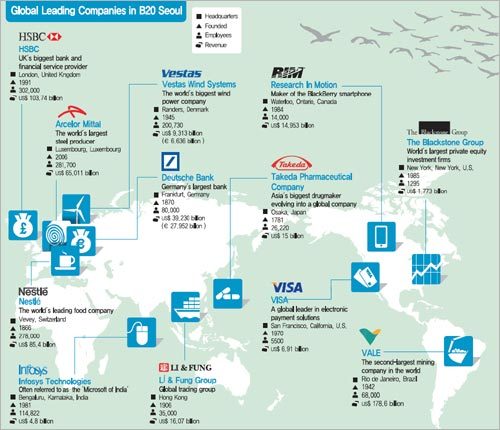

The Seoul B20 Business Summit, gathering 120 senior executives from some of the world’s top companies,is being likened to the “Olympic Games” of commerce: The accumulated annual sales of participating firms have reached US$4 trillion. Below are introductions to a selected few companies.

Hey, Big Spender

Among firms in attendance, the biggest in terms of sales is Royal Dutch Shell, a global oil conglomerate headquartered in the Hague, Netherlands. With 2009 sales reaching US$285.1 billion, it was ranked second in “Fortune” magazine’s annual ranking of the world’s 500 largest companies. The oil giant produces 3.1 million barrels of oil per day and operates more than 44,000 service stations in 90 countries around the globe.

ING Group, established more than 160 years ago, is a financial institution of Dutch origin boasting total assets of US$1.67 trillion and sales amounting to US$163.2 billion. The group employs about 110,000 people in over 40 count-ries.

Since ING Life, a member of ING Group, made its entry into the Korean market 20 years ago, it has been actively investing in Korea, as reflected in its 5.02 percent share of KB Financial Group, the country’s biggest finance firm. Though ING received a bail-out from the Dutch government during the 2008 global financial crisis, it has made a quick recovery by carrying out an aggressive restructuring plan that included a complete separation of its banking and insurance operations.

American IT firm Hewlett-Packard was founded in 1939 in a garage in Palo Alto, California, when two young engineers, Bill Hewlett and David Packard, started developing an oscillator. The company has now become a giant global enterprise, recording annual sales of US$114.6 billion. HP is a producer of some 25,000 types of IT products including computers, peripheral devices, electronic measurement and testing equipment and network equipment. It entered the Korean market in 1984.

Crisis Masters

Among the globe’s top ten financial institutions, a total of seven, including the biggest three, will participate in the B20. Many of these institutions, pushed to the brink during the global financial crisis, are now showing signs of a full-fledged recovery as they repay bailout money.

The Bank of America (BOA), based in Charlotte, North Carolina, has about 6,100 branches and over 18,000 ATMs across the United States. The bank has customers in over 150 nations around the globe and business relations with 99 percent of the Fortune 500 U.S. companies and 83 percent of the Fortune Global 500 companies.

J.P. Morgan Chase & Co. is the second largest financial institution in the United States, with managed assets worth US$2 trillion. Headquartered in New York, it is operating in 60 countries around the world with 220,000 employees. The group emerged in 2000 as the largest Wall Street bank following the merger of investment bank JP Morgan and commercial bank Chase Manhattan.

The bank further expanded through the acquisition of Bank One, the fifth-largest bank holding company in the United States in 2004, followed by that of Bear Stearns in 2008. In the same year, it also bought the banking operations of Washington Mutual, Inc., to grow its business further.

The history of Citigroup, based in New York, began with the founding of the City Bank of New York in 1812. After a series of mergers, it has become the third largest bank in the U.S. boasting a global financial services network with some 350,000 employees and over 200 million customers in more than 100 countries.

Citigroup was on the verge of nation-alization during the 2008 global financial crisis, but thanks to a massive restruc-turing effort, it is back on the path to recovery and has repaid US$20 billion of US$45 billion of bailout money.

HSBC Holdings, headquartered in London, was founded by Thomas Sutherland in 1865 as the Hong Kong and Shanghai Banking Corporation Limited. With more than 6,500 offices in about 80 nations across the globe, it offers wide-ranging services in retail banking, wholesale banking, corporate banking, pensions and insurance.

Although it was hit hard by the financial crisis in 2008 - the group reported a loss of US$15.5 billion in North America alone - it has successfully managed to diversify investments into emerging markets.

Industrial and Commercial Bank of China Ltd. is the largest bank in China. Established in 1984, the bank successfully launched IPOs in Shanghai and Hong Kong simultaneously in October 2006, raising a record US$21.9 billion.That sum makes it the largest IPO in history.

Old Boys’ Network

Companies participating in the Seoul B20 have, on average, 73 years of history. The oldest is Japan-based Takeda Pharmaceutical Company Limited, the largest drug maker in Asia, which celebrates its 229th anniversary this year, followed by J.P. Morgan Chase & Co. (211 years), and Belgium-based Umicore (205 years).

Among the 10 longest-lived companies attending the B20, five are financial institutions while four are energy-related enterprises.

Established in 1781, Takeda Pharma-ceutical Company is the largest drug maker in Japan and Asia. With annual sales of US$15 billion, it employs about 20,000 people not only in Japan but also in the United States, the United Kingdom, Singapore, Italy, Ireland, China and India. Up until the 1980s, Takeda’s business was limited to selling vitamin supplements and bulk pharmaceuticals to the United States.

However, the company grew rapidly by reinforcing competitiveness in new drug development and advancing into overseas markets. One overseas move was the acquisition of American biotech firm Millennium Pharmaceuticals, creating a stir in the industry.

Belgium-based Umicore, founded in 1805, is one of the world’s largest materials technology groups with some 17,000 employees. First established in Africa to develop mineral resources including non-ferrous precious metals, the company recently saw great success by manufacturing rechargeable batteries that use primary products such as nickel and lithium as core materials, based on extensive R&D.

Spurred by the development of the IT industry, resulting in an explosive increase in demand for rechargeable batteries used in mobile phones, game devices and laptops, Umicore’s growth continues unabated.

Color of Sustainability

The Seoul G20 Business Summit brings together many companies operating in green products and green energy, including the world’s number one companies in the fields of water, wind, and nuclear power.

One is Veolia Environment, which supplies water to 163 million people across the globe. Established in 1853, this French multinational is the number one water company in the world with a global presence in 66 countries and 2009 revenues amounting to US$17.6 billion.

Veolia has recently expanded its business areas into plant construction, plant operations, consulting and financial services. It is also making active investments in R&D.

Vestas Wind Systems, the world’s largest wind energy group, is based in Denmark. It has installed more than 39,000 turbines in 63 countries, and installs a new turbine, on average, every three hours somewhere on the planet. With a 20 percent global market share, Vestas is putting into practice its slogan “No.1 in Modern Energy” by generating approximately 60 million kilowatts per hour of electricity a year.

Italian utility firm Enel has been making a range of efforts to develop renewable energy, as seen in the installation of Italy’s first 16 megawatt hydrogen power plant near Venice. Enel is Italy’s largest energy company, and Europe’s third-largest listed utility in terms of market capital-ization.

Advance, Fair Youth

A number of companies led by young entrepreneurs in their 40s are seizing global attention. These firms share one thing in common: rapid growth attributable to quick decisions and aggressive investments made by CEOs.

Severstal, Russia’s largest steel producer, is led by 45-year-old Alexey Mordashov, the youngest of the senior excecutives among the Seoul B20 participants.

In 2009, World Steel Dynamics, a global steel information service, ranked Severstal number one in its comprehensive assessment of production capacity, management capacity, assets, sales and manufacturing technology.

Adil Said Ahmed Al Shanfari is the 46-year-old CEO of SHANFARI Group, Oman’s 4th-largest conglomerate. Specializing in civil engineering and oil refining, the group has accumulated massive wealth in Salalah, an international trading port and the second largest city in Oman.

Dogus Group, which owns Garanti, Turkey’s largest bank, is led by 47-year-old Ferit Sahenk.

And Canada’s Research in Motion (RIM) the company that produces Blackberry, the most popular smart-phone model in North America, is headed by 49-year-old Jim Balsillie.

By Kim Ki-yong

kky@donga.com

트렌드뉴스

-

1

하메네이 사망에 ‘트럼프 댄스’ 환호…이란 여성 정체 밝혀졌다

-

2

트럼프 안 겁내는 스페인…공습 협조 거부하고 무역 협박도 무시

-

3

美국방 “폭탄 무제한 비축…이틀내 이란 영공 완전 장악할것”

-

4

오세훈, 국힘 공천 받으려면 ‘1대1 결선’ 거쳐야 할듯

-

5

하메네이 장례식 연기…이란 “전례 없는 인파 우려”

-

6

구로구 대형교회 목사, 헌금 7억 빼돌려 ‘경쟁자 청부수사’ 의뢰

-

7

[김순덕 칼럼]‘삼권장악 대통령’으로 역사에 기록될 텐가

-

8

“배런을 전쟁터로”…트럼프 아들 입대 촉구 SNS 확산

-

9

‘람보르길리’ 김길리, 샤넬 모델로 변신…“새로운 모습 발견”

-

10

차량 앞서 쓰러진 천공기…1초차로 참사 피했다

-

1

‘증시 패닉’ 어제보다 더했다…코스피 12%, 코스닥 14% 폭락

-

2

“美, 하메네이처럼 김정은 제거 어렵다…北, 한국에 핵무기 쏠 위험”

-

3

“혁명수비대 업은 강경파” vs “빈살만식 개혁 가능”…하메네이 차남 엇갈린 평가

-

4

주가 폭락에…코스피·코스닥 서킷브레이커 발동

-

5

“한국 교회 큰 위기…설교 강단서 복음의 본질 회복해야”

-

6

국힘 또 ‘징계 정치’… 한동훈과 대구行 8명 윤리위 제소

-

7

李 “檢 수사·기소권으로 증거조작…강도·살인보다 나쁜 짓”

-

8

정청래 “조희대, 사법개혁 저항군 우두머리냐? 사퇴도 타이밍 있다”

-

9

李 “필리핀 대통령에 수감된 한국인 마약왕 인도 요청”

-

10

트럼프 “호르무즈 유조선 美해군이 호위”…유가 급등에 대응

트렌드뉴스

-

1

하메네이 사망에 ‘트럼프 댄스’ 환호…이란 여성 정체 밝혀졌다

-

2

트럼프 안 겁내는 스페인…공습 협조 거부하고 무역 협박도 무시

-

3

美국방 “폭탄 무제한 비축…이틀내 이란 영공 완전 장악할것”

-

4

오세훈, 국힘 공천 받으려면 ‘1대1 결선’ 거쳐야 할듯

-

5

하메네이 장례식 연기…이란 “전례 없는 인파 우려”

-

6

구로구 대형교회 목사, 헌금 7억 빼돌려 ‘경쟁자 청부수사’ 의뢰

-

7

[김순덕 칼럼]‘삼권장악 대통령’으로 역사에 기록될 텐가

-

8

“배런을 전쟁터로”…트럼프 아들 입대 촉구 SNS 확산

-

9

‘람보르길리’ 김길리, 샤넬 모델로 변신…“새로운 모습 발견”

-

10

차량 앞서 쓰러진 천공기…1초차로 참사 피했다

-

1

‘증시 패닉’ 어제보다 더했다…코스피 12%, 코스닥 14% 폭락

-

2

“美, 하메네이처럼 김정은 제거 어렵다…北, 한국에 핵무기 쏠 위험”

-

3

“혁명수비대 업은 강경파” vs “빈살만식 개혁 가능”…하메네이 차남 엇갈린 평가

-

4

주가 폭락에…코스피·코스닥 서킷브레이커 발동

-

5

“한국 교회 큰 위기…설교 강단서 복음의 본질 회복해야”

-

6

국힘 또 ‘징계 정치’… 한동훈과 대구行 8명 윤리위 제소

-

7

李 “檢 수사·기소권으로 증거조작…강도·살인보다 나쁜 짓”

-

8

정청래 “조희대, 사법개혁 저항군 우두머리냐? 사퇴도 타이밍 있다”

-

9

李 “필리핀 대통령에 수감된 한국인 마약왕 인도 요청”

-

10

트럼프 “호르무즈 유조선 美해군이 호위”…유가 급등에 대응

-

- 좋아요

- 0개

-

- 슬퍼요

- 0개

-

- 화나요

- 0개

댓글 0