U.S. benchmark interests rate expected to surpass 5% next year

U.S. benchmark interests rate expected to surpass 5% next year

Posted December. 07, 2022 07:52,

Updated December. 07, 2022 07:52

Global financial market was thrown into turmoil again on Monday (local time) as fears grew over yet another intensive money tightening by the U.S. Fed. The market turbulence is closely linked to the U.S. job report and index related to the services sector released respectively on Friday and Monday that have been translated as pressures driving up inflation.

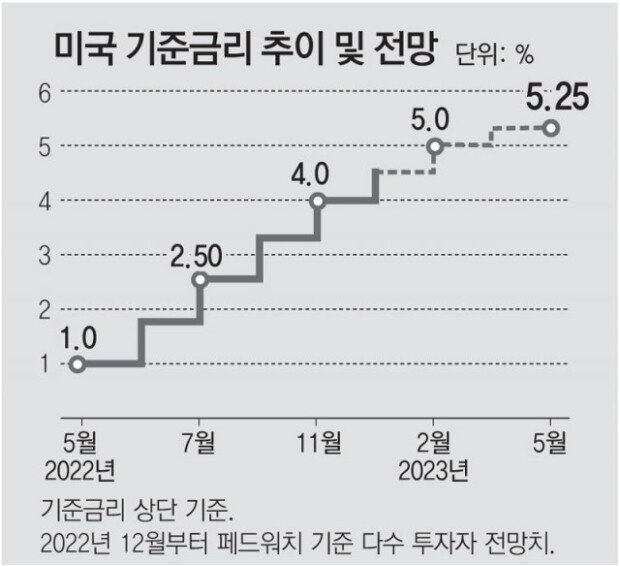

Concerns are rising that the Fed may continue to pursue the current money tightening trend by taking "big steps," that is raising the interest rates by more than 0.5 percentage points, in the Federal Open Market Committee (FOMC) meetings slated for December 2022 and February 2023. The NYSE index plummeted including the Nasdaq plunging by 1.93% as many started to forecast that the benchmark interest rate may exceed 5% next year. On the contrary, the U.S. Treasury bond yield soared. The U.S. dollar index also rose by around 0.7% from below 104 to over 105.

The won-dollar exchange rate also surged by more than 20 won. The exchange rate closed at 1,318.8 won on Tuesday, up 26.2 won from the previous day. The KOSPI index closed at 2,393.16, down 26.16 points (1.08%) from the previous day as both foreign and institutional investors were on a selling trend. KOSDAQ index also plummeted by 1.89%.

The Wall Street Journal reported that the Fed may raise the benchmark interest rate ultimately by more than 5% and even consider taking yet another big step next February. It means that the Fed may increase the rate by 0.5% not only this December, which many in the market already expect, but in the FOMC meeting scheduled in February next year. The Fed will set the key interest rate for this month at the FOMC meeting to be held on December 13 and 14.

Chicago Mercantile Exchange FedWatch, which analyzes possibilities of changes to the Fed rate based on futures trading, also showed heightened possibilities of two consecutive big steps, yielding a 79.4% probability of the benchmark interest rate reaching between 4.25% and 4.5% this month from the current 3.75 and 4.0% range and 64.5% probability of the rate exceeding 4.75 and 5.0% range in February next year.

The U.S. Department of Labor released the data on Friday that there were 263,000 new hires in the non-agricultural sector in November, far surpassing the market expectation of 200,000. U.S. ISM (Institute for Supply Management) also announced on Monday that the PMI (Purchasing Managers' Index) for the non-agricultural (services) sector in November reached 56.5, surpassing the market prediction of 53.7 and also that of October at 54.4. Both of the figures released can drive up inflation.

Hyoun-Soo Kim kimhs@donga.com · Min-Woo Park minwoo@donga.com

Headline News

- N. Korea launches cyberattacks on S. Korea's defense companies

- Major university hospital professors consider a day off each week

- Italy suffers from fiscal deficits from ‘Super Bonus’ scheme

- Inter Milan secures 20th Serie A title, surpassing AC Milan

- Ruling and opposition prioritize spending amid tax revenue shortfalls