Bithumb error sends 620,000 bitcoin to users

Bithumb error sends 620,000 bitcoin to users

Posted February. 09, 2026 08:28,

Updated February. 09, 2026 08:28

A major controversy has erupted after Bithumb, South Korea’s second-largest cryptocurrency exchange, mistakenly transferred 2,000 bitcoin per user instead of 2,000 won while distributing promotional rewards. The error resulted in the distribution of 620,000 bitcoin, about 15 times Bithumb’s actual bitcoin holdings of 42,619. The exchange later described the assets as unissued “ghost coins,” with the total value estimated at roughly 61 trillion won.

Some customers who unexpectedly received massive amounts of bitcoin quickly sold the assets for cash or used them to purchase other cryptocurrencies, fueling market volatility. The incident triggered a sharp decline in bitcoin prices on the exchange and raised broader concerns about systemic vulnerabilities in cryptocurrency markets. As tens of trillions of won worth of nonexistent assets were traded due to a single input error, questions have intensified over whether crypto exchanges are subject to adequate regulatory oversight. Scrutiny has also focused on the slow initial response by both Bithumb and financial authorities.

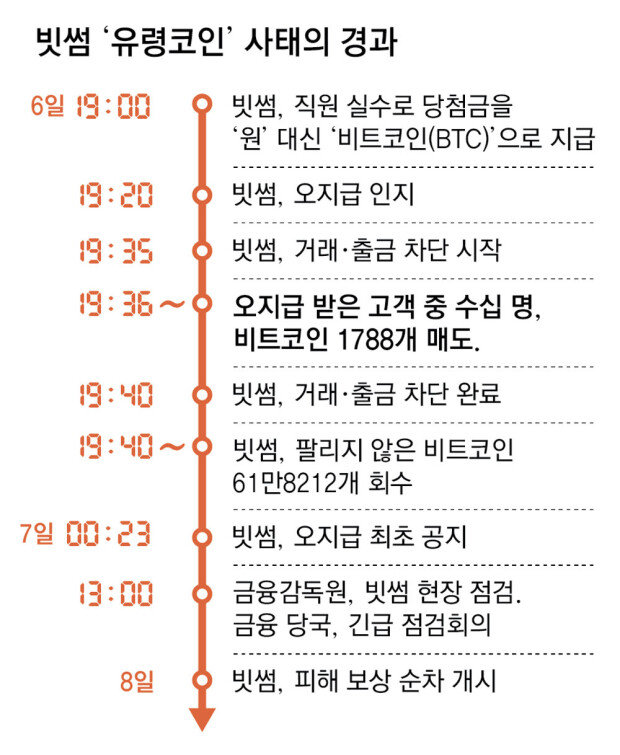

According to industry officials on Feb. 8, the error occurred at about 7 p.m. on Feb. 6, when a Bithumb employee mistakenly entered the payment unit as bitcoin instead of won while distributing prizes for a “random box” promotional event. The company had intended to distribute a total of 620,000 won to 249 of the 695 participants, with individual rewards ranging from 2,000 won to 50,000 won. Instead, 620,000 bitcoin were transferred. At the time, bitcoin was trading at about 98 million won per coin, putting the erroneous payout at an estimated 61 trillion won.

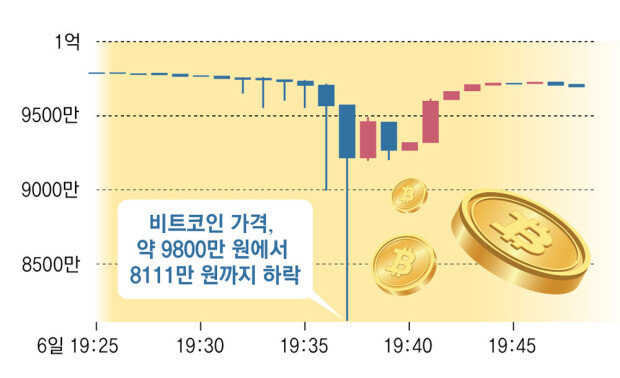

As some recipients sold the mistakenly transferred bitcoin, the price of bitcoin fell as much as 16 percent within one to two minutes, briefly plunging to 81.11 million won. Bithumb said it identified the error within 20 minutes and immediately suspended trading and withdrawals. The exchange reported that it recovered 99.7 percent of the mistakenly issued assets, or 618,212 of the 620,000 bitcoin transferred in error.

Of the remaining 1,788 bitcoin that were sold on the market, 93 percent, or 1,663 bitcoin valued at about 1.63 trillion won, was recovered in cash. The remaining 7 percent, or 125 bitcoin worth roughly 12.3 billion won, has yet to be recovered. That amount is believed to have already been withdrawn as cash or used to purchase other cryptocurrencies.

Lee Hyo-seop, head of the financial industry division at the Korea Capital Market Institute, said the incident showed that the exchange lacked systems capable of detecting payouts that exceeded its actual asset holdings. He said institutional reforms are necessary to ensure cryptocurrency exchanges establish internal control mechanisms comparable to those required of traditional financial institutions.

홍석호 기자 will@donga.com

![[단독]실수로 ‘비트코인 벼락’… 80여명 바로 매도, 1분새 16% 폭락](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/09/133322702.1.jpg)

![[천광암 칼럼]쿠팡 김범석의 오만과 한국의 자존심](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/08/133322162.1.jpg)