Helping Find Hidden Insurance Benefits and Even Filing Claims: “GREEN-RIBBON Corp”

Helping Find Hidden Insurance Benefits and Even Filing Claims: “GREEN-RIBBON Corp”

Posted September. 18, 2025 09:44,

Updated October. 28, 2025 18:40

- GREEN-RIBBON Corp is an insur-tech company that helps policyholders uncover

and claim hidden insurance benefits, addressing the information asymmetry

in the insurance industry.

- Lifecatch, offers both B2C and B2B services, including claim-filing support,

fraud detection, and medical history checks.

- Additionally, they have expanded into healthcare with their Green-scout solution,

which aids in clinical trial participant recruitment and new drug demand

forecasting.

Insurance is often cited as one of the most information-asymmetric services. Many policyholders give up on claiming benefits due to complicated terms and procedures, or they are unaware of the benefits they are entitled to. GREEN-RIBBON Corp is an insur-tech company tackling this information asymmetry with technology, ensuring that policyholders can exercise their rightful claims. We met Myung-ho Cheon, CTO of GREEN-RIBBON Corp, at the company’s office in Yeouido, who explained how the firm is expanding its technology into clinical trial recruitment and new drug demand forecasting.

Insurance Is a Right, Not a Benefit. Developing a Platform That Handles Everything from Coverage Analysis to Post-Management

GREEN-RIBBON Corp has a mission to raise public awareness that “insurance is not a benefit but a right,” and to realize consumer rights through its services.

“My experience shows that most policyholders do not clearly understand the terms of their insurance products because they are too vast and complicated. For instance, if someone receives coverage from auto insurance after an accident, they often assume driver’s insurance cannot also provide coverage. But in reality, overlapping benefits are often possible, yet many miss out on their rights,” said CTO Cheon. “In many cases, people even give up on filing claims altogether because of the complex paperwork and procedures in their busy daily lives. That’s why GREEN-RIBBON developed a platform that not only finds missed insurance benefits but also connects coverage analysis, design, sales, post-management, and even claim filing into one seamless process”

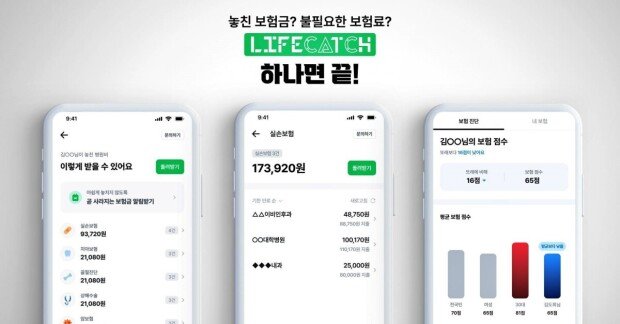

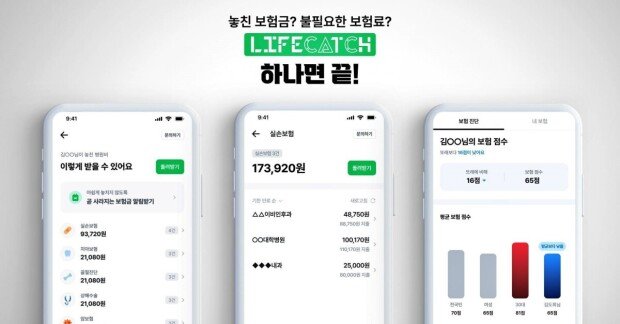

The company’s platform ‘Lifecatch’, is divided into B2C and B2B services. The B2C service helps users directly file insurance claims or receive claim-filing support, while also providing expense records, details of insurance benefits received, hospital recommendations by symptoms, and unclaimed insurance benefit finder feature.

For insurers, the B2B Software-as-a-Service (SaaS) version uses AI to support quick decision-making in areas such as fraud detection and medical history checks, while also automating repetitive tasks to improve operational efficiency.

Cheon explained, “After officially launching the Lifecatch app in 2021, we analyzed user data and found that many missed claims were for smaller amounts—under KRW 500,000—rather than for large medical expenses. Many users were unaware of long-term hospital visits over three years or that their right to claim for actual expense insurance expires after three years. That’s why we added the hidden insurance finder function. By applying Large Language Models (LLM) and Retrieval-Augmented Generation (RAG), we filtered only the necessary documents for claims, reducing issuance costs. This feature was very well received. As of September 2025, Lifecatch has 2.4 million subscribers. Most actively use the hidden insurance finder, and some request claim-filing services, which has resulted in 410,000 completed cases. By advancing the service with precise data such as health check-up data from the National Health Insurance Service, we supplied hidden insurance finder and claim-filing services to platforms like Toss and various insurers. Presenting Lifecatch through multiple platforms was key to our success.”

He added, “There are many memorable users, but in July one customer discovered, through Lifecatch, KRW 614,700 in insurance benefits he hadn’t even known about for three years. He was so moved by the unexpected refund that he called our customer center to express his gratitude. This gave the whole team a renewed sense of pride and strengthened our mission to help policyholders reclaim their rights.”

Not satisfied with these achievements, GREEN-RIBBON Corp continues to focus on R&D to deliver more advanced services.

“Although Lifecatch has 2.4 million subscribers, considering there are about 48 million insurance policyholders in Korea, we still have a long way to go,” said Cheon. “We will continue expanding the service so more people can reclaim missed insurance benefits and simplify cumbersome claim procedures. To do this, we are focusing on upgrading our technology to cover the entire insurance process. For example, we are developing a specialized AI assistant for policyholders that can help with insurance-related inquiries and post-management. This year, we standardized claim-filing processes, enhanced coverage analysis with LLM, and designed a simplified screening assistant flow, laying the groundwork for the AI assistant. However, as there are still limitations to what AI can do, we are also pursuing collaborations with partners such as independent adjusters, insurers, and sales agents, and developing support tools they can use.”

He continued, “In the process of developing the B2B SaaS service for insurers, we were selected for the Jungle ASAP program jointly run by Seoul National University of Science and Technology and AWS, which was a great help. The program provided market, pricing, and technology strategies essential for SaaS companies, as well as references from other SaaS businesses that helped GREEN-RIBBON chart its path forward.”

Expanding into Healthcare by Leveraging Over 2.4 Million Claims and Medical Records

GREEN-RIBBON Corp also launched a new solution, Green-scout, which features clinical trial data analysis and participant recruitment function.

Cheon explained, “Through operating Lifecatch, we analyzed more than 2.4 million claims and medical histories, which allowed us to help users receive refunds. This process accumulated high-quality, pure data. Based on this, we developed Green-scout to quickly and accurately recruit clinical trial participants, reducing recruitment failures. Previously, recruiting trial participants meant visiting hospitals, searching blogs, or even posting subway ads, which was inefficient. As a result, recruitment typically took around 140 days, but with Green-scout, it now takes about 14 days. Because we filter only the right participants based on our accumulated claims, diagnosis, and prescription data, pharmaceutical companies and research institutions reported shorter trial durations and reduced costs.”

He added, “The 2.4 million claims and medical history data are also valuable for identifying new drug candidates. Accurate recruitment of trial participants is key to successful drug development. We are also expanding collaborations with companies that need new drug demand forecasting and analysis. We expect Green-scout to be highly useful in the healthcare field.”

Finally, Cheon emphasized the company’s commitment to developing services that provide real value to consumers.

“I still remember the countless trials and errors we faced at the beginning,” he said. “To ensure accuracy, we manually checked insurance benefits against countless diagnosis codes and coverage terms. With confidence that we could deliver a truly useful service, we overcame these struggles and launched Lifecatch. Every time we receive feedback from users thanking us for helping them find hidden benefits, we feel proud and rewarded.”

He added, “We will continue to enhance our service by expanding automation. For example, we plan to modularize document processing, decision logic, and consultation assistance to reduce repetitive costs. We will also focus on the new clinical trial business, presenting Lifecatch as an app that spans not only the insurance industry but also health, finance, and healthcare.”

By Dong-jin Kim (kdj@itdonga.com)

* This article was written with support from Seoul National University of Science and Technology.

and claim hidden insurance benefits, addressing the information asymmetry

in the insurance industry.

- Lifecatch, offers both B2C and B2B services, including claim-filing support,

fraud detection, and medical history checks.

- Additionally, they have expanded into healthcare with their Green-scout solution,

which aids in clinical trial participant recruitment and new drug demand

forecasting.

Insurance is often cited as one of the most information-asymmetric services. Many policyholders give up on claiming benefits due to complicated terms and procedures, or they are unaware of the benefits they are entitled to. GREEN-RIBBON Corp is an insur-tech company tackling this information asymmetry with technology, ensuring that policyholders can exercise their rightful claims. We met Myung-ho Cheon, CTO of GREEN-RIBBON Corp, at the company’s office in Yeouido, who explained how the firm is expanding its technology into clinical trial recruitment and new drug demand forecasting.

Myung-ho Cheon, CTO of GREEN-RIBBON Corp / Source IT dongA

Insurance Is a Right, Not a Benefit. Developing a Platform That Handles Everything from Coverage Analysis to Post-Management

GREEN-RIBBON Corp has a mission to raise public awareness that “insurance is not a benefit but a right,” and to realize consumer rights through its services.

“My experience shows that most policyholders do not clearly understand the terms of their insurance products because they are too vast and complicated. For instance, if someone receives coverage from auto insurance after an accident, they often assume driver’s insurance cannot also provide coverage. But in reality, overlapping benefits are often possible, yet many miss out on their rights,” said CTO Cheon. “In many cases, people even give up on filing claims altogether because of the complex paperwork and procedures in their busy daily lives. That’s why GREEN-RIBBON developed a platform that not only finds missed insurance benefits but also connects coverage analysis, design, sales, post-management, and even claim filing into one seamless process”

The company’s platform ‘Lifecatch’, is divided into B2C and B2B services. The B2C service helps users directly file insurance claims or receive claim-filing support, while also providing expense records, details of insurance benefits received, hospital recommendations by symptoms, and unclaimed insurance benefit finder feature.

Lifecatch for B2C users / Source=GREEN-RIBBON Corp

For insurers, the B2B Software-as-a-Service (SaaS) version uses AI to support quick decision-making in areas such as fraud detection and medical history checks, while also automating repetitive tasks to improve operational efficiency.

Lifecatch for B2B users / Source=GREEN-RIBBON Corp

Cheon explained, “After officially launching the Lifecatch app in 2021, we analyzed user data and found that many missed claims were for smaller amounts—under KRW 500,000—rather than for large medical expenses. Many users were unaware of long-term hospital visits over three years or that their right to claim for actual expense insurance expires after three years. That’s why we added the hidden insurance finder function. By applying Large Language Models (LLM) and Retrieval-Augmented Generation (RAG), we filtered only the necessary documents for claims, reducing issuance costs. This feature was very well received. As of September 2025, Lifecatch has 2.4 million subscribers. Most actively use the hidden insurance finder, and some request claim-filing services, which has resulted in 410,000 completed cases. By advancing the service with precise data such as health check-up data from the National Health Insurance Service, we supplied hidden insurance finder and claim-filing services to platforms like Toss and various insurers. Presenting Lifecatch through multiple platforms was key to our success.”

He added, “There are many memorable users, but in July one customer discovered, through Lifecatch, KRW 614,700 in insurance benefits he hadn’t even known about for three years. He was so moved by the unexpected refund that he called our customer center to express his gratitude. This gave the whole team a renewed sense of pride and strengthened our mission to help policyholders reclaim their rights.”

Not satisfied with these achievements, GREEN-RIBBON Corp continues to focus on R&D to deliver more advanced services.

“Although Lifecatch has 2.4 million subscribers, considering there are about 48 million insurance policyholders in Korea, we still have a long way to go,” said Cheon. “We will continue expanding the service so more people can reclaim missed insurance benefits and simplify cumbersome claim procedures. To do this, we are focusing on upgrading our technology to cover the entire insurance process. For example, we are developing a specialized AI assistant for policyholders that can help with insurance-related inquiries and post-management. This year, we standardized claim-filing processes, enhanced coverage analysis with LLM, and designed a simplified screening assistant flow, laying the groundwork for the AI assistant. However, as there are still limitations to what AI can do, we are also pursuing collaborations with partners such as independent adjusters, insurers, and sales agents, and developing support tools they can use.”

He continued, “In the process of developing the B2B SaaS service for insurers, we were selected for the Jungle ASAP program jointly run by Seoul National University of Science and Technology and AWS, which was a great help. The program provided market, pricing, and technology strategies essential for SaaS companies, as well as references from other SaaS businesses that helped GREEN-RIBBON chart its path forward.”

Expanding into Healthcare by Leveraging Over 2.4 Million Claims and Medical Records

GREEN-RIBBON Corp also launched a new solution, Green-scout, which features clinical trial data analysis and participant recruitment function.

Green-scout service image / Source=GREEN-RIBBON Corp

Cheon explained, “Through operating Lifecatch, we analyzed more than 2.4 million claims and medical histories, which allowed us to help users receive refunds. This process accumulated high-quality, pure data. Based on this, we developed Green-scout to quickly and accurately recruit clinical trial participants, reducing recruitment failures. Previously, recruiting trial participants meant visiting hospitals, searching blogs, or even posting subway ads, which was inefficient. As a result, recruitment typically took around 140 days, but with Green-scout, it now takes about 14 days. Because we filter only the right participants based on our accumulated claims, diagnosis, and prescription data, pharmaceutical companies and research institutions reported shorter trial durations and reduced costs.”

He added, “The 2.4 million claims and medical history data are also valuable for identifying new drug candidates. Accurate recruitment of trial participants is key to successful drug development. We are also expanding collaborations with companies that need new drug demand forecasting and analysis. We expect Green-scout to be highly useful in the healthcare field.”

Finally, Cheon emphasized the company’s commitment to developing services that provide real value to consumers.

“I still remember the countless trials and errors we faced at the beginning,” he said. “To ensure accuracy, we manually checked insurance benefits against countless diagnosis codes and coverage terms. With confidence that we could deliver a truly useful service, we overcame these struggles and launched Lifecatch. Every time we receive feedback from users thanking us for helping them find hidden benefits, we feel proud and rewarded.”

Myung-ho Cheon, CTO of GREEN-RIBBON Corp / Source=IT Donga

He added, “We will continue to enhance our service by expanding automation. For example, we plan to modularize document processing, decision logic, and consultation assistance to reduce repetitive costs. We will also focus on the new clinical trial business, presenting Lifecatch as an app that spans not only the insurance industry but also health, finance, and healthcare.”

By Dong-jin Kim (kdj@itdonga.com)

* This article was written with support from Seoul National University of Science and Technology.

![쓸개 파열로 “사흘 남았다” 판정받은 시인…18년뒤 “너를 아껴라” 속삭여[손효림의 베스트셀러 레시피]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/01/08/133113134.1.jpg)