Why Japanese consumers are reluctant to open their wallets

Why Japanese consumers are reluctant to open their wallets

Posted April. 11, 2016 07:24,

Updated April. 11, 2016 07:31

Uniqlo, the largest clothing company in Japan has lowered its product price by 300-1,000 Japanese yen (approx. 2.8 - 9 U.S. dollars) since February. Having pushed up its price by 5-10 percent in two consecutive years from 2014, the company was directly hit by the ramification of the price increase. Net profit in the fiscal year 2016 (between September 2015 and August 2016) is expected to be cut by 45 percent compared to the previous year. “It’s for maintaining the product quality,” said Uniqlo Chairman Tadashi Yanai, when he was announcing the price increase back then. On Thursday at press conference, however, he hang out a white flag, saying, “We wish to go back to affordable price for our product.”

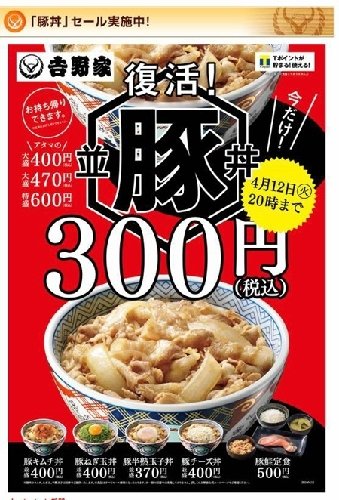

Skylark, the biggest family restaurant chain in Japan, reorganized its menus in February and introduced many of low and middle priced lunch menus at 499 Japanese yen (approx. 5,320 won or 4.6 dollars). Sources from food manufacturer called Shinojaki said on Nihon Keizai Shinbun that they had raised the product prices by using domestic red beans as they expected increased sales of highly-priced products on Abenomics. But there were fewer consumers and their wallets were closed even more tightly than expected. The company has recently expanded low price product at 108 yen (approx. 1 dollar) including consumption tax.

There are two reasons why Japanese consumers don’t open their wallets. For one, while Abenomics that feature quantitative easing and fiscal expansion have pushed up companies’ profits, this hasn’t led to salary increase of employees. Real wages with inflation went down by 0.9 percent last year, which has been down for four consecutive years. Bank of Japan Governor Haruhiko Kuroda vented out his concerns to Nobel-winning economist Joseph Stiglitz who was visiting Japan last month by saying, “It’s hard to understand why the rate of wage increase is slow.”

Some analyze that Japanese people tend to immediately go back to frugality at the news of consumption tax increase or slow economy in China because of bitter experience of “lost two decades.” Prime Minister Shinzo Abe expressed his anxiety to professor Paul Krugman at Princeton University by saying that he doesn’t understand why the influence of consumption tax increase in Japan is bigger than in Europe. Japan’s average propensity to consume (expenditure out of disposable income) in 2015 went to back to the level of pre-Abenomics in 2012 at 73.8 percent.

도쿄=장원재특파원 peacechaos@donga.com

![[단독]통일교 ‘한학자 보고문건’에 ‘전재수’ 최소 7번 등장](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2025/12/22/133015670.1.jpg)

![[단독]“尹당선인에 용산이전 관련 한학자 의중 전해”](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2025/12/22/133016392.1.jpg)