Big 3 shipbuilders expected to record surplus in 2H23

Big 3 shipbuilders expected to record surplus in 2H23

Posted August. 15, 2023 08:22,

Updated August. 15, 2023 08:22

There is a rosy outlook that domestic "Big 3" shipbuilders such as Korea Shipbuilding & Offshore Engineering, Samsung Heavy Industries, and Hanwha Ocean will succeed in turning to black (TTB) in the second half of the year. This is because ship prices, which are considered an indicator of the profitability of shipbuilders, are steadily rising.

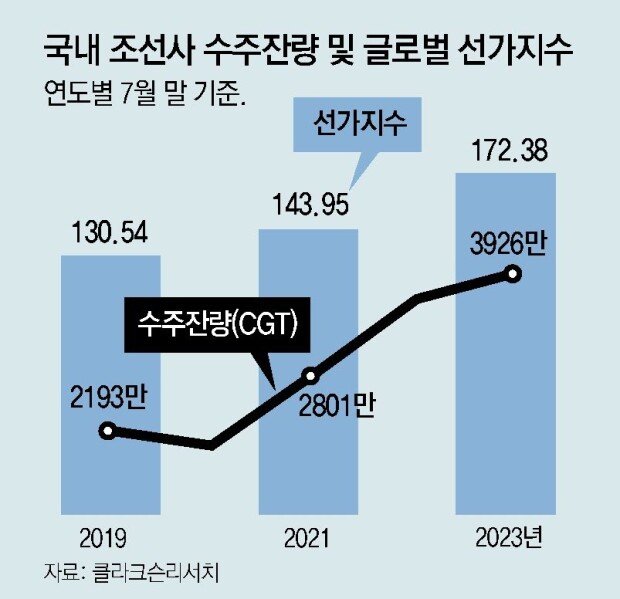

According to Clarkson Research, a British shipbuilding and shipping market condition company, on the 14th, Korean shipbuilders received orders for 1.46 million CGT, or 44% of the 3.33 million CGT in global ship orders in July, effectively pushing China (1.13 million CGT, 34%) to second place and taking first place in monthly order wins in 5 months. Cumulative orders from January to July stood at 6.94 million CGT, down 41% YoY.

What shipbuilders are paying more attention to than order performance is the Newbuilding Price Index (NPI). In 1998, the global shipbuilding price average was set at 100, and the indexed NPI was 172.38 last month, up 10.8 points from the same period last year (161.58). It is 92.6% of the all-time high of 186.15 points set in April 2008, which was a super cycle.

The area in which domestic shipbuilders are excelling is green ships. HD Korea Shipbuilding & Offshore Engineering, the shipbuilding holding company of HD Hyundai, won orders for 18 out of 34 liquefied natural gas (LNG) carriers ordered worldwide in the first half of the year. During the same period, Samsung Heavy Industries and Hanwha Ocean also won orders for six and four LNG carriers, respectively. The three domestic shipbuilders raked in 82.4% of the world's LNG carrier orders.

Following HD Hyundai Heavy Industries and Samsung Heavy Industries, which succeeded in TTB in the second quarter of this year, there are predictions that even Hanwha Ocean can achieve a quarterly surplus in the second half of the year.

Jae-Hyeng Kim monami@donga.com

![연금 개시 가능해지면 年 1만 원은 꼭 인출하세요[은퇴 레시피]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/20/133390850.4.jpg)

![취권하는 중국 로봇, ‘쇼’인 줄 알았더니 ‘데이터 스펀지’였다?[딥다이브]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/20/133391101.1.png)