Kosdaq rises as KOSPI pauses near 5,000

Kosdaq rises as KOSPI pauses near 5,000

Posted January. 24, 2026 08:36,

Updated January. 24, 2026 08:43

As the KOSPI enters the 5,000 era, the KOSDAQ index is closing in on the long-awaited 1,000 mark. With the government having achieved its “KOSPI 5,000” pledge ahead of schedule, expectations are growing that developing the KOSDAQ market will become the next policy focus.

On Friday, the KOSDAQ index rose 2.43 percent to close at 993.93. It climbed as high as 998.32 during the session, briefly approaching the 1,000 level. Individual investors sold shares worth 1.036 trillion won, but institutional investors stepped in with net purchases of 987.4 billion won, nearly 1 trillion won, helping lift the index. Foreign investors also contributed, buying a net 86.6 billion won in shares.

All of the top 10 KOSDAQ stocks by market capitalization rose on Thursday. Shares of Altogen, a market bellwether that had recently slumped after disclosed royalty rates fell short of expectations, gained 4.73 percent. Other underperforming biotechnology stocks also rebounded, including ABL Bio, up 10.24 percent, and Samchundang Pharm, which jumped 13.74 percent. Secondary battery and robotics stocks such as EcoPro BM, rising 1.1 percent, and Rainbow Robotics, up 7.58 percent, also closed higher.

The KOSDAQ’s sharp gains contrasted with the KOSPI, which briefly hit a record intraday high of 5,021.13 before trimming its advance to close at 4,990.07, up 0.76 percent. Market participants said the KOSPI appears to be entering a consolidation phase after surpassing the 5,000 mark, with sector rotation under way. Profit-taking emerged in stocks that had posted steep gains this year, including Hyundai Motor and Hanwha Aerospace, while investors shifted toward KOSDAQ-listed companies that had lagged.

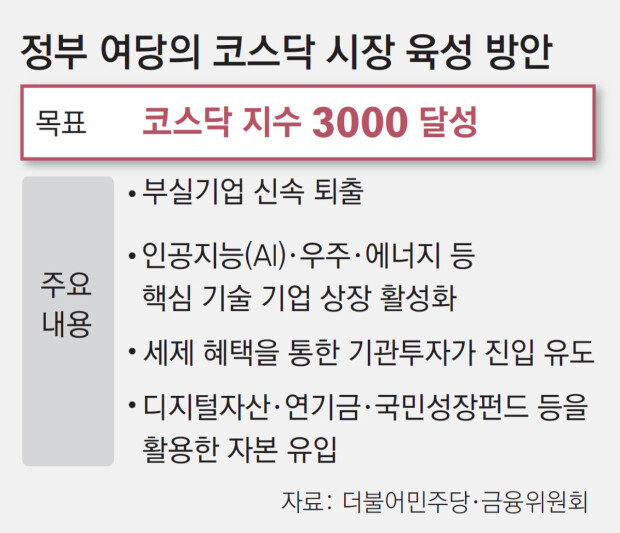

Optimism was further supported by reports that members of the Democratic Party of Korea’s “KOSPI 5,000 Special Committee,” who met with President Lee Jae-myung for lunch the previous day, proposed targeting a KOSDAQ index of 3,000 next. The government and ruling party are pursuing measures to swiftly remove underperforming companies from the market while encouraging initial public offerings by firms in core technology sectors such as artificial intelligence, space and energy. Expanded investment in venture capital, including securities and loan bonds issued by small and mid-sized firms, along with the public-private National Growth Fund, is also expected to benefit the KOSDAQ market, where smaller companies account for a larger share.

The ruling party’s renewed focus on the KOSDAQ reflects the index’s relatively sluggish performance compared with the KOSPI. Since the end of 2024, the KOSPI has surged 107.96 percent, while the KOSDAQ has risen just 46.56 percent. The index has not closed above 1,000 for more than four years, last reaching 1,009.62 on Jan. 5, 2022.

While investors pin hopes on government stimulus measures, market watchers caution that structural limitations remain due to weakening fundamentals among KOSDAQ-listed companies. Jung Yong-taek, an analyst at IBK Investment & Securities, said the government’s support policies are likely to produce gradual effects. He added that in an increasingly polarized K-shaped economy, small and mid-sized firms facing both earnings and credit risks may see limited gains in both performance and share prices.

홍석호 기자 will@donga.com

![[광화문에서/김준일]단식 마친 장동혁… 중요한 건 단식 그 다음](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/01/23/133221688.1.jpg)

![라면 먹고도 후회 안 하는 7가지 방법[노화설계]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/01/23/133219600.3.jpg)