Pension contribution may amount to one third of income by 2060

Pension contribution may amount to one third of income by 2060

Posted April. 01, 2023 08:07,

Updated April. 01, 2023 08:07

Estimates forecast that, if Korea's National Pension Service (NPS) continues to manage the pension funds the same way as now, the payouts will dry up by 2055. Subscribers may have to pay up to 34% of their monthly income for monthly pension contributions by 2060, a 3.8 times higher ratio than the current 9%. The findings further suggested that the fund depletion may be delayed for about five years if the agency's return on investment is increased by 1% point. However, many think it would be challenging considering various factors, including the recent economic slowdown.

The NPS committee on pension-related financial estimates under the purview of the Ministry of Health and Welfare released its fifth outlook on March 31. The Korean government issues pension-related estimates every five years by the National Pension Act, including the estimated time when the funds will run dry. The committee previously unveiled a tentative assessment in January this year, which was confirmed in the latest March report. The final assessment included two additional scenarios in which how contribution rates may change if the fertility rate declines further than assumed in the January version.

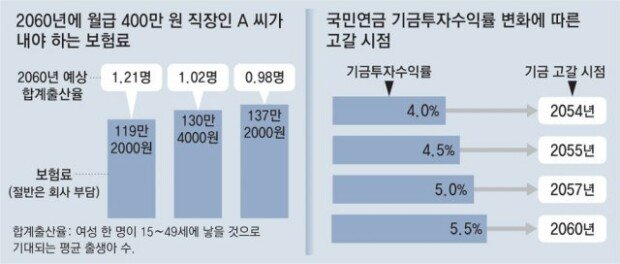

The January assessment predicted that the funds would be depleted by 2055 if the total fertility rate stood at 1.21 as of the year 2046, and the contribution rates (under the pay-as-you-go system) would shoot up to 29.8% by 2060. The total fertility rate refers to the average number of births expected from a woman of childbearing age between 15 and 49. Currently, pension payouts are drawn from the accumulated funds, but the funds will be run under the pay-as-you-go system by 2060 as they will have run dry, and changed contribution rates will be applied accordingly.

The committee released two different scenarios in the final assessment applied with different total fertility rates of 0.98 by 2054 and 1.02 by 2050, respectively.

The former scenario assumes the worst possible birth rate situation. The estimate of dry-up remains the same as in 2055 in this case, however, the contribution rates climb up to 34.3% as individual burden increases due to a decline in both population and the number of pension subscribers. The latter scenario suggests that the rates would go up by 32.6%.

To put in perspective, an office worker with a monthly earning of 4 million Korean won may have to pay as much as 1.372 million for monthly pension contribution if the total fertility rate is 0.98, 1.304 million if the rate is 1.02, and 1.192 million if the rate is 1.21. The office worker and his/her employer each will be paying 50% of the contribution.

Korea's current national pension system collects contributions from the subscribers (born in 1969 or after) until they are 59 years old and begins providing payouts when they are 65. With the present structure, youngsters (born in 2001 or after) may have to pay more than 34% of their monthly income for pension by 2060. The so-called generation MZ, who would be working hard in colleges and dreaming of their future career paths, may be caught in a pension trap if the current system remains unchanged.

The ministry is expected to submit a reform plan based on the latest assessment to the National Assembly by the end of October 2023. However, concerns are mounting that the drive for pension reform may be weakened due to the general elections scheduled in just six months from announcing the envisioned reform plan.

ksy@donga.com

Headline News

- N. Korea launches cyberattacks on S. Korea's defense companies

- Major university hospital professors consider a day off each week

- Italy suffers from fiscal deficits from ‘Super Bonus’ scheme

- Inter Milan secures 20th Serie A title, surpassing AC Milan

- Ruling and opposition prioritize spending amid tax revenue shortfalls