Won volatility persists despite U.S., BOK moves

Won volatility persists despite U.S., BOK moves

Posted January. 16, 2026 08:56,

Updated January. 16, 2026 08:56

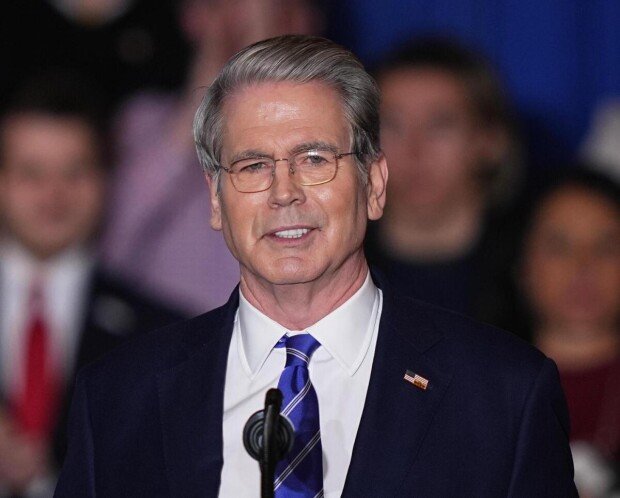

U.S. Treasury Secretary Scott Bessent said on Jan. 14, local time, that the weakening of the South Korean won does not align with South Korea’s solid economic fundamentals. It is rare for a U.S. Treasury secretary to make such remarks, which amounted to a verbal intervention signaling that a rising won-dollar exchange rate, or a weaker won, was undesirable.

A day later, on Jan. 15, the Bank of Korea decided to keep its benchmark interest rate unchanged at 2.50 percent, citing concerns over elevated exchange rates. The decision marked the fifth consecutive rate hold. Despite what amounted to coordinated action by South Korea and the United States through verbal guidance and a rate freeze, the won-dollar exchange rate climbed back into the 1,470-won range during intraday trading. The move underscored the market’s resistance to intervention and did little to ease concerns over persistently high exchange-rate levels.

Bessent wrote on social media platform X, formerly Twitter, on Jan. 14 that he had met with South Korean Deputy Prime Minister Gu Yun-cheol for a ministerial-level meeting on critical minerals and had discussed recent market developments in South Korea. He added that a decline in the value of the won was undesirable. Shortly after the remarks, the won strengthened in overnight trading, which ended at 2 a.m. on Jan. 15, with the exchange rate falling to 1,464 won per dollar.

The rebound proved short-lived. The won resumed its decline later in the morning in the Seoul foreign exchange market and closed at 1,469.7 won per dollar as of 3:30 p.m. Compared with the previous day’s daytime session, the rate fell by 7.8 won, marking its first decline in 11 trading days. Even so, analysts said the impact of the verbal intervention lasted little more than half a day.

According to Choi Ji-young, director general for international economic affairs at the Ministry of Economy and Finance, the finance ministers of the two countries shared concerns over the recent sharp depreciation of the won and agreed that a stable currency is a key factor for bilateral trade and economic cooperation. He said that, to his recollection, a U.S. Treasury secretary had never before commented on South Korea’s exchange rate in a personal capacity.

The Bank of Korea’s Monetary Policy Board also held its first monetary policy meeting of the year on Jan. 15 and decided to keep the benchmark interest rate unchanged as part of efforts to shore up the won. Bank of Korea Gov. Lee Chang-yong said it could not be denied that exchange-rate considerations played an important role in the decision, adding that it was natural to prepare short-term supply-and-demand measures to help stabilize the currency.

Despite the coordinated responses by South Korean and U.S. authorities, the won-dollar exchange rate climbed as high as 1,472.4 won during intraday trading in the daytime session. Market observers said investors viewed the lower exchange rate created by official intervention as an opportunity to buy dollars at relatively cheaper levels. Kang In-soo, a professor of economics at Sookmyung Women’s University, said stabilizing the exchange rate would require structural and fundamental solutions, including clear incentives to encourage foreign capital inflows.

지민구 warum@donga.com