Korea's technology, shipbuilding gain from APEC summit

Korea's technology, shipbuilding gain from APEC summit

Posted November. 03, 2025 08:05,

Updated November. 03, 2025 08:05

As the 2025 Asia-Pacific Economic Cooperation summit in Gyeongju concluded, attention turned to its impact on South Korea’s industrial sector. Analysts widely agreed that artificial intelligence semiconductors were among the biggest beneficiaries. The summit also brought a positive resolution to long-standing concerns over U.S.-Korea tariff negotiations and the U.S.-China trade dispute.

● Semiconductors, AI infrastructure, and automobiles lead gains

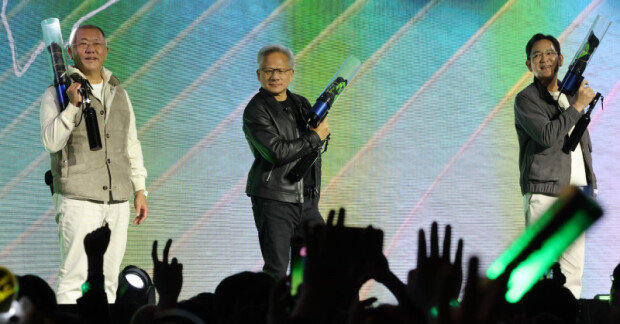

Industry sources on Nov. 2 identified semiconductors as the top sector to benefit from APEC. NVIDIA CEO Jensen Huang strengthened the so-called private AI alliance during a casual meeting with Samsung Electronics Chairman Lee Jae-yong and Hyundai Motor Group Chairman Chung Eui-sun, a gathering often referred to as chimaek, or chicken and beer. NVIDIA also agreed to supply 260,000 of its graphics processing units to South Korea, where they are in high demand.

NVIDIA announced plans to expand collaboration with South Korean semiconductor firms, including Samsung Electronics and SK hynix. The company will secure large volumes of high-bandwidth memory, DRAM, and NAND flash, all essential for AI chip production, while bolstering its AI factory initiatives.

Samsung has emerged as one of the top beneficiaries. The company has secured the supply of HBM4, the next-generation high-bandwidth memory, to NVIDIA and is reportedly developing applications for NVIDIA’s robotics platform.

With partnerships forming with global AI firms such as NVIDIA and Amazon Web Services, South Korea’s AI infrastructure sector, including data centers, is expected to benefit significantly. Most of the NVIDIA GPUs entering the country will be used to build AI data centers.

The automotive and robotics sectors are also expected to benefit. Hyundai Motor Group will receive 50,000 additional GPUs from NVIDIA, boosting projects in software-defined vehicles, autonomous driving, and robotics. A Hyundai spokesperson said, “We expect to enhance vehicle functionality and performance using NVIDIA’s AI inference models and software.” Other positive developments for the domestic automotive sector included the U.S. reducing tariffs on Korean cars from 25 percent to 15 percent during APEC and the temporary suspension of China’s rare-earth export controls.

The shipbuilding industry also drew attention after U.S. President Donald Trump approved the construction of nuclear-powered submarines. Analysts noted a double boost for Hanwha Ocean, as Canadian Prime Minister Mark Carney visited its Geoje facility ahead of a 60 trillion won submarine project decision on Oct. 30.

● Steel and petrochemicals miss rebound opportunities

By contrast, the steel industry has struggled to recover. Tariffs of up to 50 percent imposed by the United States and the European Union, along with continued low-price competition from China, have left the sector under a “triple squeeze.” No measures were announced at APEC to ease these challenges.

Similarly, discussions at APEC on strengthening climate regulations have negatively affected industries with high carbon emissions, including petroleum refining and petrochemicals. “For South Korea, which supplies 80 percent of the world’s memory semiconductors, strengthened collaboration with NVIDIA is a substantial boon," said Kim Dae-jong, a business administration professor at Sejong University. "The resolution of U.S.-Korea tariff talks during APEC has also helped reduce industrial uncertainty.”

이동훈 기자 dhlee@donga.com