Korean Exchange activates first circuit breaker in 8 years

Korean Exchange activates first circuit breaker in 8 years

Posted March. 13, 2020 07:44,

Updated March. 13, 2020 07:48

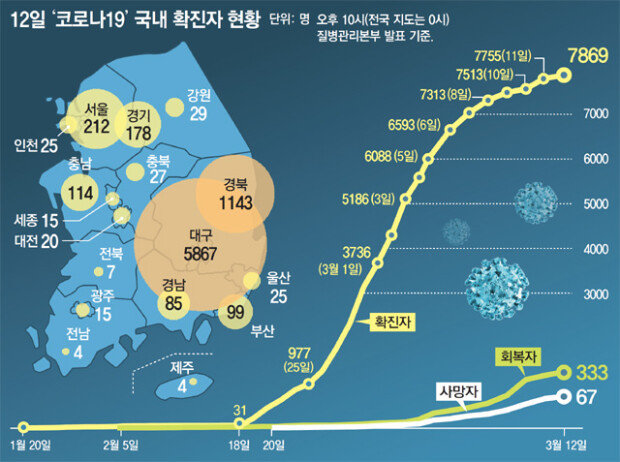

Amid the rapid spread of recent respiratory illness caused by a novel coronavirus and the policy uncertainty to contain the virus called COVID-19, global financial markets fluctuated again on Thursday. Experts voice the concern that the stock markets are showing a crisis pattern where stock prices plummet before recovering temporarily and falling again.

KOSPI tanked over 5% on Thursday before it was closed at 1,834.33, down 73.94 points (3.87%) from a day earlier. The closing price was the lowest in four years and seven months since August 24, 2015, when it hit the bottom at 1,829.81.

As the prices of futures plunged, the Korean Exchange activated the sidecar at 1:04 p.m. to suspend the trading for five minutes. The last time the sidecar was activated at the Korean bourse was Oct. 4, 2011, eight years and five months ago.

It was foreign investors that led the fall of KOSPI, selling 900 billion won at securities market alone. The amount of shares that foreign investors sold over the past month at KOSPI reaches 10 trillion won. Owing to the selling spree, the won-dollar exchange rate rose Thursday by 13.5 won to 1206.05 won per dollar. It is the sharpest depreciation of the won in seven months since August 5.

Stock markets across the world tanked on the day after the World Health Organization officially declared COVID-19 a pandemic. Market fear was further exacerbated as the U.S., the bedrock of the global economy, has yet to announce a stimulus package.

Gun-Huk Lee gun@donga.com

![[단독]내란특검 “尹계엄 목적은 민주-한동훈 등 반대 세력 제거”](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2025/12/04/132897558.1.jpg)

![‘친구’란 말에, 치매 아버지는 고향땅 800평을 팔았다[히어로콘텐츠/헌트①-上]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2025/12/14/132961909.1.jpg)