1.75M borrowers repay principal and interest bigger than income

1.75M borrowers repay principal and interest bigger than income

Posted July. 03, 2023 07:38,

Updated July. 03, 2023 07:38

A 22-year-old woman working part time at a factory had to take out a loan worth 32 million won to cover living expenses after getting pregnant. A low credit limit led her to visit and ask a bank that she has a main account and other banks to take out four loans eventually. “I earn 2.5 million won per month and spend as much as 700,000 won repaying my loans,” she said. “I still feel worried about possibly facing financial difficulties if I lose my job. I have managed to get by somehow by working extra hours and going to work on holidays."

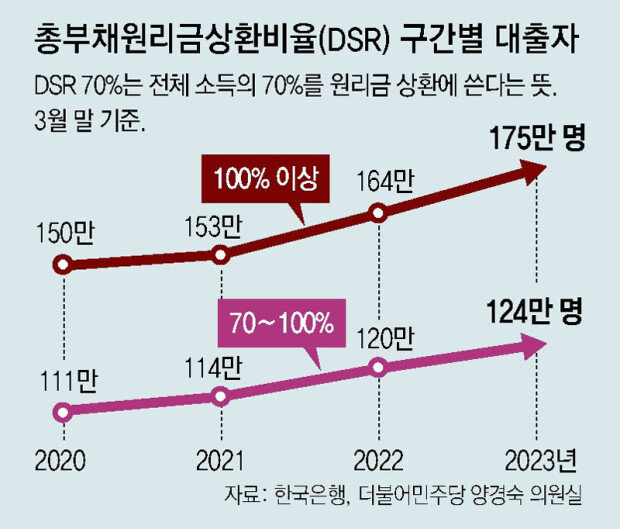

As many as three million citizens are struggling with a growing debt since the pandemic, only finding it challenging to maintain a minimum standard of living. More miserably, 1.75 million of the needy group cannot cover repayments even if they pour in a whole income. While rising default rates of household loans cause anxiety across the financial market, consumers have no choice but to tighten their purse strings. With that, experts are concerned that an economic recovery is unlikely scenario to develop by the latter half of the year.

Given that the total debt service ratio is 40.3 percent, it is assumed that those who borrowed money from domestic banks as of the end of this year’s first quarter have to spend 40 percent of their annual income repaying their debt.

Worryingly, 1.75 million household debt borrowers earn less or the same amount as their principal and interest to repay. Out of the total borrowers, 8.9 percent have a debt savings ratio (DSR) higher than 100 percent. Their ratio has increased since the third quarter of 2020 (7.6 percent).

With borrowers with a DSR of 70 percent or above included, the total number is 2.99 million. Financial authorities and banking organizations normally consider a DSR over 70 percent a threshold over which most of a borrower's income should be used to repay debt excluding minimum living expenses. Given this, around three million loan borrowers are deeply stuck in debt that they cannot even maintain their lives. Their loans even account for 41.4 percent of the total loan balance.

syeon@donga.com · 1am@donga.com