MiDeal Unveils 'Fintag' Optimization Solution To Help Corporate Financial Asset Management At CES 2026

MiDeal Unveils 'Fintag' Optimization Solution To Help Corporate Financial Asset Management At CES 2026

Posted January. 06, 2026 10:39,

- MiDealwill unveil "Fintag 2.0" at CES 2026, an AI-powered financial asset optimization solution designed to help SMEs manage irregular cash flows through real-time analysis and predictive algorithms.

- The platform connects with banks, securities firms, and tax services to provide a "Real-Time RAG" chatbot, allowing users to monitor funds and plan future procurement through simple conversation without complex accounting knowledge.

- Supported by Sungkyunkwan University’s Seoul RISE project, MiDeal aims to use its CES debut to expand into the Asian B2B market, including Vietnam and Indonesia, positioning itself as a leading financial infrastructure provider.

The Seoul Business Agency (SBA, CEO Hyun-woo Kim), an organization dedicated to vitalizing Seoul's startup ecosystem and discovering promising ventures, will operate the Seoul Pavilion at CES 2026 in January. Led by the SBA, 19 startup support organizations based in Seoul—including autonomous districts, related agencies, and universities—are participating to support a total of 70 startups. The Seoul Pavilion provides various business programs such as on-site investment consultations, buyer matching, global IR pitching, and exhibition booth operations to establish a foothold for global expansion. MiDeal is a prominent startup recommended and supported as part of Sungkyunkwan University’s Seoul RISE project.

MiDeal will showcase Fintag, a corporate financial asset optimization solution, at the Consumer Electronics Show (CES 2026) held in Las Vegas, Nevada, from January 6 to 9. MiDeal’s Fintag assists in corporate financial management by applying AI-based Future Cash Flow Prediction algorithm technology and real-time file analysis and chatbots (Real-Time RAG).

Even today, many small and medium-sized enterprises face operational difficulties due to irregular cash flows and the absence of systematic fund management systems. To solve these field-level problems, MiDeal's Fintag connects various financial institutions such as banks, securities firms, and card companies, as well as the National Tax Service’s Hometax. It has developed a proprietary cash flow prediction algorithm that combines collected financial data with tax invoice data. Companies using the Fintag service can identify their real-time fund status simply through conversations with a chatbot without separate complex accounting or professional knowledge, and can establish fund procurement and management plans based on future cash flows predicted by AI.

The version to be unveiled at CES 2026 is Fintag 2.0, and a demo booth where visitors can directly experience the simulation will be operated. MiDeal intends to increase brand awareness through simple financial asset management demonstrations while exploring ways for global companies that have entered the Korean market to adopt Fintag services for the fund management of their subsidiaries. Starting with the role of an AI Financial Secretary for SMEs lacking systematic fund management systems, MiDeal seeks to expand into middle-market and large enterprises, as well as B2B markets in Asia, including Vietnam and Indonesia.

Thanks to the support of Sungkyunkwan University’s Seoul RISE project and our participation in the CES 2026 Seoul Pavilion, we were able to showcase Fintag’s AI-based fund management technology to both domestic and international companies, said Sang-hoon Jung, CEO of MiDeal. He shared his ambition, stating, Taking this participation in CES as an opportunity, we will leap forward as Asia’s No. 1 B2B Financial Infrastructure that spreads the success formula of Korean SMEs to the global market.

By Si-hyeon Nam (sh@itdonga.com)

- The platform connects with banks, securities firms, and tax services to provide a "Real-Time RAG" chatbot, allowing users to monitor funds and plan future procurement through simple conversation without complex accounting knowledge.

- Supported by Sungkyunkwan University’s Seoul RISE project, MiDeal aims to use its CES debut to expand into the Asian B2B market, including Vietnam and Indonesia, positioning itself as a leading financial infrastructure provider.

The Seoul Business Agency (SBA, CEO Hyun-woo Kim), an organization dedicated to vitalizing Seoul's startup ecosystem and discovering promising ventures, will operate the Seoul Pavilion at CES 2026 in January. Led by the SBA, 19 startup support organizations based in Seoul—including autonomous districts, related agencies, and universities—are participating to support a total of 70 startups. The Seoul Pavilion provides various business programs such as on-site investment consultations, buyer matching, global IR pitching, and exhibition booth operations to establish a foothold for global expansion. MiDeal is a prominent startup recommended and supported as part of Sungkyunkwan University’s Seoul RISE project.

MiDeal's solution to optimizing corporate financial assets 'Fintag' / source=MiDeal

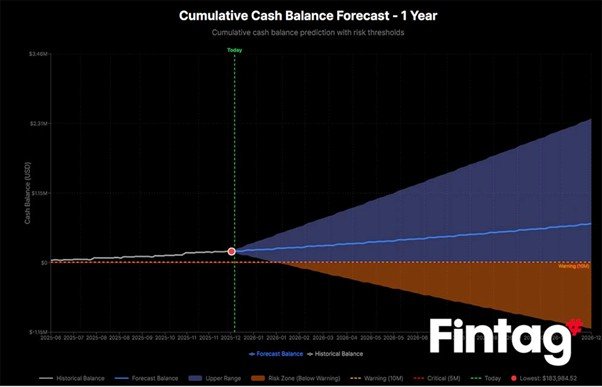

MiDeal will showcase Fintag, a corporate financial asset optimization solution, at the Consumer Electronics Show (CES 2026) held in Las Vegas, Nevada, from January 6 to 9. MiDeal’s Fintag assists in corporate financial management by applying AI-based Future Cash Flow Prediction algorithm technology and real-time file analysis and chatbots (Real-Time RAG).

Even today, many small and medium-sized enterprises face operational difficulties due to irregular cash flows and the absence of systematic fund management systems. To solve these field-level problems, MiDeal's Fintag connects various financial institutions such as banks, securities firms, and card companies, as well as the National Tax Service’s Hometax. It has developed a proprietary cash flow prediction algorithm that combines collected financial data with tax invoice data. Companies using the Fintag service can identify their real-time fund status simply through conversations with a chatbot without separate complex accounting or professional knowledge, and can establish fund procurement and management plans based on future cash flows predicted by AI.

Image of cash flow prediction algorithm of 'Fintag AI 2.0' to be introduced at CES 2026 / source=MiDeal

The version to be unveiled at CES 2026 is Fintag 2.0, and a demo booth where visitors can directly experience the simulation will be operated. MiDeal intends to increase brand awareness through simple financial asset management demonstrations while exploring ways for global companies that have entered the Korean market to adopt Fintag services for the fund management of their subsidiaries. Starting with the role of an AI Financial Secretary for SMEs lacking systematic fund management systems, MiDeal seeks to expand into middle-market and large enterprises, as well as B2B markets in Asia, including Vietnam and Indonesia.

Thanks to the support of Sungkyunkwan University’s Seoul RISE project and our participation in the CES 2026 Seoul Pavilion, we were able to showcase Fintag’s AI-based fund management technology to both domestic and international companies, said Sang-hoon Jung, CEO of MiDeal. He shared his ambition, stating, Taking this participation in CES as an opportunity, we will leap forward as Asia’s No. 1 B2B Financial Infrastructure that spreads the success formula of Korean SMEs to the global market.

By Si-hyeon Nam (sh@itdonga.com)

![[단독]‘아들 주택 11채’ 김경, 공천 보류됐다 강선우가 밀어붙여 구제](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/01/07/133103173.6.jpg)