Memory chip stocks soar on AI demand outlook

Memory chip stocks soar on AI demand outlook

Posted September. 23, 2025 08:19,

Updated September. 23, 2025 08:19

“A warm winter this year,” is how global investment bank Morgan Stanley described the outlook for the memory semiconductor industry in a report released Sept. 22. Titled “Memory Supercycle—Rising AI Wave Lifts All Boats,” the report noted a global shortage of memory chips. Among South Korean manufacturers, Morgan Stanley named Samsung Electronics as its preferred stock, raising its target price to 96,000 won per share, up 12% from 86,000 won.

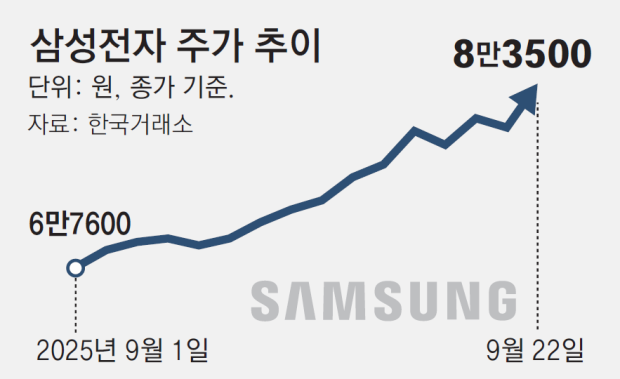

Samsung Electronics’ stock has surged relentlessly since the beginning of September. Driven by expectations of an industry recovery, it has risen 19.8% this month alone. On the day of Morgan Stanley’s report, it closed at 83,500 won per share, up 4.77% from the previous trading day, hitting a 52-week high. The jump followed news that Samsung’s fifth-generation high-bandwidth memory (HBM) HBM3E 12-stack product passed NVIDIA’s quality tests. Previously, Samsung had struggled to supply its 5th-generation HBM to NVIDIA, its largest customer.

Reflecting market optimism, major brokerage firms have raised their price targets for Samsung this month. Mirae Asset Securities increased its target by 15.6% from 96,000 won to 111,000 won per share. Hanwha Investment & Securities, IBK Investment & Securities, and SK Securities all projected 110,000 won, while Daol Investment & Securities and Shin Young Securities set their targets at 100,000 won. The brokerages cited Samsung’s operating profit of around 4 trillion won in the second quarter, down 55.2% from a year earlier, and predicted a recovery to roughly 9 trillion won in the third quarter as the basis for the revised targets.

Optimism over a semiconductor boom has led to forecasts that the KOSPI could reach a year-end high of 3,800. If the performance of Samsung Electronics and SK hynix, the twin engines of the KOSPI and leading domestic semiconductor companies, improves, the index could have further room to rise.

However, U.S. tariffs on semiconductor products remain a potential risk. Recently, U.S President Donald Trump suggested that semiconductors, which have high profit margins, could face tariffs even higher than the 25% applied to automobiles.

한재희 기자 hee@donga.com

![17년 망명 끝에, 부모 원수 내쫓고 집권[지금, 이 사람]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/18/133376197.3.jpg)