S. Korean investors face two different realities

S. Korean investors face two different realities

Posted December. 03, 2020 08:01,

Updated December. 03, 2020 08:01

Both Nikola, a hydrogen truck manufacturer, and Nano-X, a digital x-ray company, were listed on Nasdaq this year amid much fanfare. After being mired in controversy surrounding their technologies, however, the two companies now face different fates. And so do South Korean investors who invested in them.

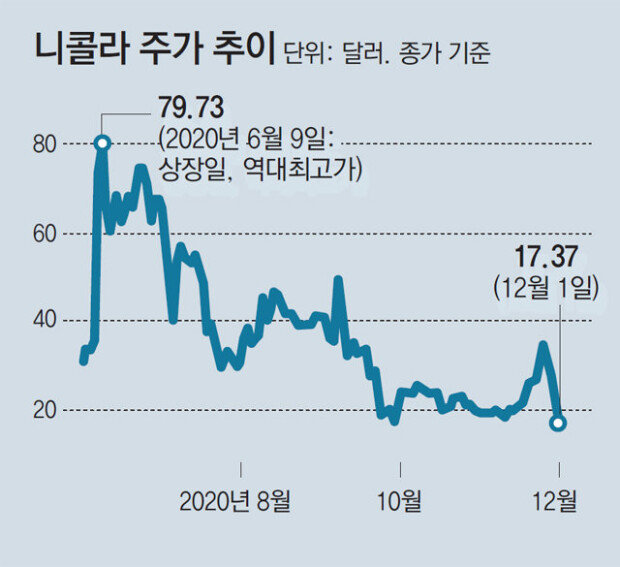

Nikola closed at 17.37 dollars on Tuesday, 14.89 percent down from the previous day, following a 26.92 percent decrease on Monday. The plunge is largely attributed to GM’s withdrawal from a two billion-dollar project on battery systems and fuel cells with the truck producer. The news that the shares of founder Trevor Milton, who resigned in controversy over “rolling downhill” video, will be eligible to be traded soon did not help either.

Nikola and Nano-X seemed to share the same fate in the beginning. Their hydrogen trucks and medical imaging were seen as innovations. They were successfully listed on U.S. Nasdaq in June and August, respectively, without finished products. At one point, their shares traded at a price 300 percent higher than the offering price. South Korean corporations Hanwha Group and SK Telecom invested in Nikola and Nano-X, respectively, and had to deal with short selling attacks after the controversy erupted.

Their fates started to diverge since then. Nano-X faced it head-on: It announced its plan for a demonstration of its device and secured investment from institutional investors. In contrast, Nikola is tumbling down after having ousted the founder and failed to demonstrate its technology.

As a consequence, South Korean investors who have invested in these foreign firms hoping for a bonanza are now facing very different realities. Nikola was the 36th largest foreign company in the South Korean stock market with South Korean investors holding approximately 160 million dollars of shares as of late November. However, investors sold their shares at a loss after seeing them plummet and it came down to below the 50th on Tuesday. On the other hand, Nano-X rose from the 27th (198 million dollars) to the 20th within a day after additional 32 million dollars of shares were purchased by South Korean investors.

zion37@donga.com