Last year`s tax revenue falls short by a record amount

Last year`s tax revenue falls short by a record amount

Posted February. 11, 2015 08:09,

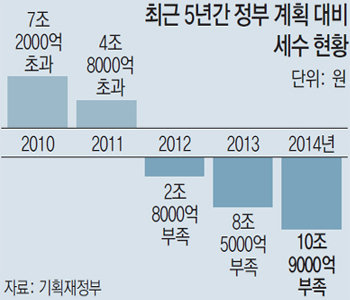

Korea`s tax revenue fell short of the government`s target by a record amount last year, with shortfall coming in at 10.9 trillion won (9.9 billion U.S. dollars). The government, however, managed to collect more taxes on wages than its target by 500 billion won (450 million dollars), while earned income tax stood at 3.4 trillion won (3.1 billion dollars).

According to the government`s 2014 fiscal year tax revenue and expenditure results released Tuesday, national tax revenue stood at 205.5 trillion won (190 billion dollars) last year. Revenue increased by 3.6 trillion won (3.3 billion dollars) from 2013, but the total amount was still 10.9 trillion (9.98 billion dollars) less than government target. This also marks three straight years of a shortfall.

Last year`s shortfall was even larger by 2.3 trillion won (2.1 billion dollars) than the amount recorded amid the Asian currency crisis in 1998 at 8.6 trillion won (7.8 billion dollars). This was due to sluggish revenue from corporate tax, customs duties and value-added tax, which are directly affected by economic conditions.

Corporate tax revenue shortfall accounted for the biggest share in total tax revenue shortfall with revenue in 2014 reaching 42.7 trillion won (39 billion dollars), 3.3 trillion won (3 billion dollars) less than the government`s target. Corporate tax was collected 1.2 trillion won (3 billion dollars) less than in 2013. Slumping operating profits due to economic slowdown was a decisive factor. The earnings before tax of companies listed in stock markets declined 10.2 percent to 51.4 trillion won (47.7 billion dollars) in 2014 from 57.2 trillion won (52.4 billion dollars) in 2013.

"The decline in corporate tax revenue was due to falling corporate earnings since no change was made in corporate tax system last year," said the Strategy and Finance Ministry. The government expects the effects of tax benefit declines in large companies last year due to tax law revision will be felt this year, and added that corporate tax revenue will increase as the economy shows recovery. Total income tax, including earned income tax, general income tax and transfer income tax, was collected 1.1 trillion won (1 billion won) less than the target, but 5.5 trillion won (5 billion dollars) more than the previous year.

The government estimated that the rise in wages and the number of employed resulted in 2 trillion won (1.8 billion dollars) of earned income tax revenue among the total 3.4 trillion won (3.1 billion dollars) increase in total earned income tax. The number of regular workers increased by 3.8 percent last year. "Tax revenue increased 1 trillion won (9.2 billion dollars) after the government changed the year-end tax settlement from income-based to tax payment," said a ministry official. This means that tax actually increased for wage earners. Considering that annual average increase in earned income tax from 2011 to 2013 stood at 2.1 trillion won (1.9 billion dollars), last year`s amount of increase was bigger than ordinary years.

![연금 개시 가능해지면 年 1만 원은 꼭 인출하세요[은퇴 레시피]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/20/133390850.4.jpg)