Low-alcohol trend reshapes global beverage market

Low-alcohol trend reshapes global beverage market

Posted February. 14, 2026 08:10,

Updated February. 14, 2026 08:10

As a culture of drinking less spreads worldwide, the alcoholic beverage market at home and abroad is undergoing rapid change. Facing slowing performance, major producers are restructuring their portfolios around lower-alcohol and alcohol-free products, accelerating a shift toward lighter drinks.

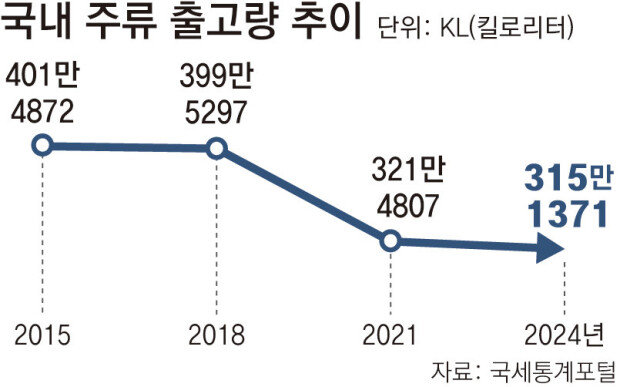

Alcohol consumption in South Korea has shown a clear downward trend over the past decade. According to the National Tax Statistics Portal, domestic liquor shipments fell from 4,014,872 kiloliters in 2015 to 3,214,807 kiloliters in 2021, during the height of the COVID-19 pandemic, and declined further to 3,151,371 kiloliters in 2024. Compared with 2015, that marks a decrease of about 21 percent over 10 years.

Corporate earnings have also been hit. According to regulatory filings, Lotte Chilsung Beverage posted revenue of 4.0245 trillion won in 2024, surpassing the 4 trillion won mark, but sales slipped 1.3 percent to 3.9711 trillion won last year. Revenue from its liquor division fell about 7.5 percent, from 813.4 billion won in 2024 to 752.7 billion won last year. Overall operating profit declined 9.6 percent to 167.2 billion won, down from 184.9 billion won a year earlier. HiteJinro’s revenue last year dropped 3.9 percent to 2.4986 trillion won from 2.5992 trillion won the previous year. Its operating profit plunged 17.3 percent to 172.1 billion won from 208.1 billion won. In a report titled “The Era of Enjoying Alcohol,” published last year, the Samil PwC Management Research Institute said the shift reflects the spread of a “sober life” trend, particularly among millennials and Generation Z, who seek to minimize alcohol consumption and pursue healthier lifestyles.

In response to weakening demand, companies are intensifying competition in lower-alcohol products by reducing the alcohol content of flagship brands. In July last year, Lotte Chilsung Beverage lowered the alcohol content of its soju brand Chum Churum from 16.5 percent to 16 percent. Last month, it also reduced the alcohol level of its zero-sugar soju Saero from 16 percent to 15.7 percent. HiteJinro’s Jinro, which debuted in 2019 at 16.9 percent alcohol, has also been gradually reduced, reaching 15.7 percent as of Feb. 12. The rollout of nonalcoholic beer products is also expanding. Notable examples include OB Beer’s recently launched Cass All Zero and HiteJinro’s Hite Zero 0.00.

Similar trends are evident overseas. According to a report released in June last year by the International Wine and Spirits Research, global alcohol consumption totaled 477.2 billion bottles in 2024, down 1 percent from a year earlier and about 2 percent lower than in 2019, before the COVID-19 pandemic. In response, global brands have introduced alcohol-free or low-alcohol options such as Heineken 0.0, Tsingtao Non-Alcoholic and Guinness 0.0. The global nonalcoholic and alcohol-free beer market continues to expand. Market research firm Statista projects the sector will grow from $23 billion in 2020 to $40 billion in 2025 and reach $50 billion by 2029.

Marketing campaigns centered on alcohol-free products have also reached the Olympic stage. Global brewing company AB InBev promoted its alcohol-free beer Corona Cero as the official beer during the 2024 Paris Olympics. During the 2026 Milan-Cortina Winter Olympics, OB Beer has been holding consumer participation events featuring its nonalcoholic product Cass 0.0.

김다연 damong@donga.com

![월 800만 원 버는 80대 부부 “집값만 비싼 친구들이 부러워해요”[은퇴 레시피]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/13/133363096.4.jpg)

![“잠시 맡깁니다” 소방서 앞 커피 인증…시민들의 색다른 응원[e글e글]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/13/133361503.3.jpg)