Tesla’s tax benefit fuels grievance among local carmakers

Tesla’s tax benefit fuels grievance among local carmakers

Posted August. 07, 2020 07:46,

Updated August. 07, 2020 07:46

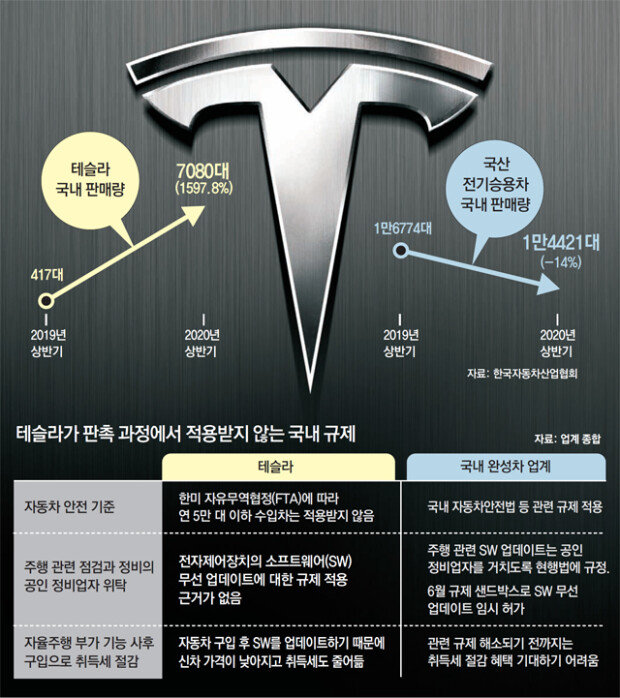

South Korean carmakers are jittery over the dominance of Tesla, which sold 7,080 cars in the first half of the year alone, taking up a 43.3% share of the entire e-vehicle market in the country. Importing less than 50,000 cars a year, Tesla is exempt from Korea’s strict auto-safety regulations and is allowed leeway to pursue more flexible sales promotions under the conditions of the free trade agreement between Seoul and Washington.

Autonomous driving assistance is a good example. Tesla comes equipped with the hardware for autopilot, and drivers can choose to pay to get software and activate the function on their own. This means that one can save up to 7.71 million won in initial purchase price while alleviating financial burden on the 7% acquisition tax. For instance, the standard version of Model 3 costs 53.69 million won, and the acquisition taxes drop from 4.3 million won to 3.76 million when autopilot option is removed.

But for the electric cars produced in Korea, any technological handling of autonomous driving system must be performed by a certified car expert. Under this rule, drivers are not allowed to upgrade their system software themselves for reason of safety issues.

Such difference stems from Korea’s free trade agreement with America. American cars that are imported in less than 50,000 units a year for sales promotion are not subjected to the safety regulations in South Korea. “Tesla’s strategy is meaningful in that it proposed a direction for the industry, but this can be perceived as counter-discrimination for the local producers as their hands are tied,” said Professor Lee Ho-geun of Daeduk University.

Hyung-Seok Seo skytree08@donga.com