Yuan officially debuts as 1 of IMF’s big 3 currencies

Yuan officially debuts as 1 of IMF’s big 3 currencies

Posted October. 03, 2016 07:25,

Updated October. 03, 2016 08:21

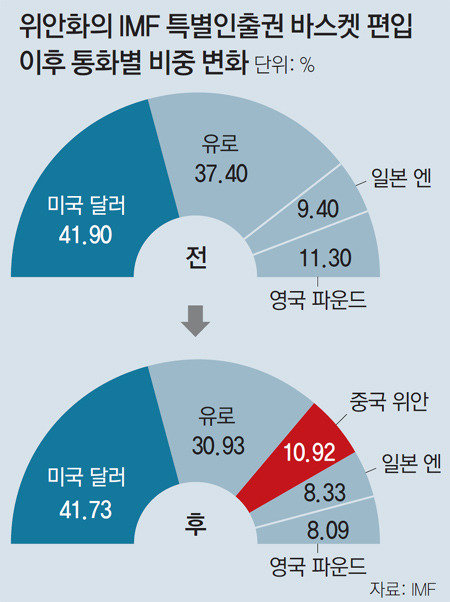

Since SDR’s inauguration in 1970, only four currencies namely the U.S. dollar, the euro (French Franc, German Mark before the Euro’s launch), the British pound, and the Japanese yen had been included in the reserve currency basket until recently. The yuan has jumped to No. 3 with a weight of 10.92 percent, after the dollar (41.73 percent), and the euro (30.93 percent), and overtook the yen (8.33 percent) and the pound (8.09 percent). Pundits say that the yuan’s inclusion in SDR heralds the onset of currency war between the greenback and the redback.

With its inclusion in the SDR, the yuan, also known as Renminbi, has ostensibly become one of the top three key currencies, but its use in the market is still quite limited. In terms of portion of currencies used in international trade as of June, the dollar was the highest at 42.5 percent, followed by the euro at 30.0 percent, and the pound at 7.5 percent, while the yuan only took up 1.7 percent. When compared with the Japanese yen, the yuan accounted for lightly more than half of the former. Even after the IMF decided to include the yuan in SDR on November 30, 2015, the portion of the yuan in foreign currency reserves at the central bank of various countries has not increased, and only took up about 1 percent. Savings that are deposited in yuan in Hong Kong’s financial institutions fell to the lowest level since 2013. For this reason, critics have constantly claimed that the yuan’s glorious inclusion in SDR stems from political consideration.

The yuan is not widely used in the global market because the level of financial and currency liberation in China is low due to the Chinese authority’s exchange rate control, and control of the currency’s entry and exit across the border. In August last year, the Chinese authority abruptly depreciated the yuan’s value by 4.7 percent in a bid to shore up China’s export.

On Friday, the eve of the day when the yuan was included in SDR, the People’s Bank of China said that it will continue to reform the mechanism through which the yuan currency’s exchange rate is formulated to advance it further. Since China is seeking to make the yuan into a key currency while controlling its currency, the international community is watching what extent China can achieve currency reform, the Wall Street Journal said.

베이징=구자룡특파원 bonhong@donga.com

![17년 망명 끝에, 부모 원수 내쫓고 집권[지금, 이 사람]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/18/133376197.3.jpg)