The Fed raises interest rates to 4 percent

The Fed raises interest rates to 4 percent

Posted November. 04, 2022 07:55,

Updated November. 04, 2022 07:55

The Federal Reserve raised the benchmark interest rate to 4 percent. Fed Chairman Jerome Powell said the terminal rate would be higher than expected, hinting the U.S. central bank could raise rates above 5 percent in 2023.

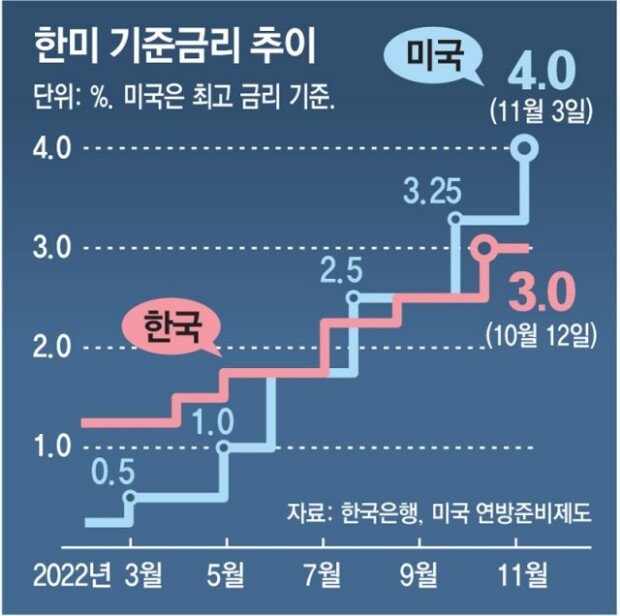

At the Federal Open Market Committee (FOMC) meeting on Wednesday (local time), the Fed took a giant step of raising the interest rate by 75 basis points, from the current range of 3.0 to 3.25 percent to a range of 3.75 to 4.0 percent. The fourth consecutive three-quarter point interest rate increase has widened the rate gap between the U.S. and Korea by as much as one percentage point.

The Fed implied that it would reduce the size of rate hikes at the December FOMC meeting to a 50-basis point hike. After the meeting, Mr. Powell said the pace of rate increases would be stepped down in December at the earliest. However, he still maintained a hawkish bias, leaning on the side of over-tightening, saying that it is “very premature” to think about or be talking about pausing rate hikes and that there were more rate hikes ahead.

Chairman Powell’s comments indicate that the Fed is considering slow but steady increases. “The question of when to moderate the pace of increases is much less important than the question of how high and how long to keep monetary policy restrictive,” Mr. Powell said.

The NASDAQ fell 3.36 percent on Wednesday in response to Mr. Powell’s commitment to keeping the restrictive monetary policy, while the 2-year treasury rose to 4.6 percent. The dollar index rose to nearly 112, implying the strong dollar will continue. The Kospi in South Korea, Hong Kong’s Hang Seng, and Japan’s Nikkei index fell.

Hyoun-Soo Kim kimhs@donga.com