Boston Dynamics valuation surges after CES 2026 showcase

Boston Dynamics valuation surges after CES 2026 showcase

Posted January. 23, 2026 09:37,

Updated January. 23, 2026 09:37

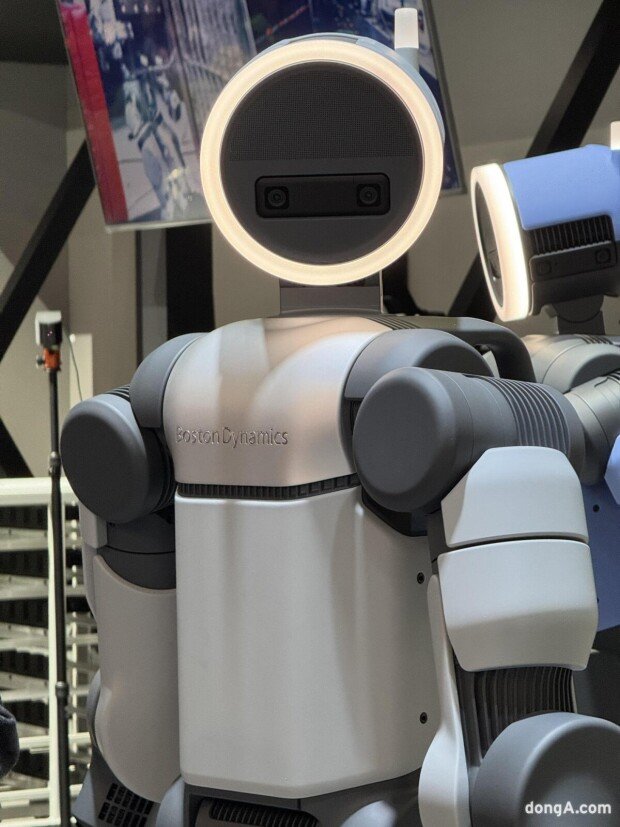

The expected value of Boston Dynamics, the robotics subsidiary of Hyundai Motor Group, is climbing on what analysts call the “Atlas effect.” The company drew global attention at CES 2026, the world’s largest information technology and consumer electronics trade show, where it demonstrated advanced humanoid robot capabilities. Following the showcase, several securities firms raised their valuation estimates.

On Jan. 22, KB Securities projected Boston Dynamics’ market value at 128 trillion won. Analysts pointed to a projected decline of more than 100 million working-age people across OECD countries and China over the next decade, a trend expected to drive global demand for humanoid robots to 9.6 million units by 2035. “Atlas alone is projected to account for about 1.5 million units, or 15.6% of the total market,” said Kang Sung-jin, an analyst at KB Securities.

Hanwha Investment & Securities estimated that Boston Dynamics’ valuation could reach 146 trillion won if the company goes public. The estimate is derived by applying Hyundai Motor Group’s market capitalization, roughly 35.5% of Tesla’s, to Tesla’s humanoid robotics business, which is valued at $280 billion, or about 397 trillion won. Daol Investment & Securities projected that Boston Dynamics could be valued at 100 trillion won by 2030, when Atlas is expected to enter mass production.

Boston Dynamics’ valuation is also high relative to its peers. U.S.-based Figure AI is valued at about 56 trillion won, while China’s UBITEC and Unitree are estimated at roughly 12 trillion won each. Analysts say the rapid rise in Boston Dynamics’ valuation reflects the company’s concrete mass-production roadmap unveiled at CES. They also point to production-ready features, including optimized joints and fingers, as well as synergies with Hyundai Mobis and Hyundai Glovis through component supply and logistics, as factors supporting the upbeat assessments.

The elevated valuation is also expected to bolster Hyundai Motor Group’s efforts to unwind its circular shareholding structure and strengthen Chairman Chung Eui-sun’s control. As Boston Dynamics’ value increases, the financial leverage of Chairman Chung, who owns about 22% of the company, is further reinforced.

Hyundai Motor Group has yet to dismantle its circular ownership. Hyundai Mobis sits at the center of the group’s governance chain, which runs Hyundai Mobis to Hyundai Motor to Kia and back to Hyundai Mobis. Chairman Chung holds only 0.3% of Hyundai Mobis shares. Combined with Honorary Chairman Chung Mong-koo’s stake, the total is around 7.7%. Industry analysts expect that if Hyundai Motor Group breaks the circular chain and vertically integrates its affiliates, Chairman Chung could acquire the Hyundai Mobis shares held by Kia, Hyundai Steel, and Glovis, potentially using funds from a Boston Dynamics IPO.

Investment analysts predict that if Boston Dynamics goes public successfully this year, Hyundai Motor Group’s governance restructuring could accelerate next year. DS Investment & Securities said, “Even accounting for taxes when Chairman Chung inherits or receives shares from Honorary Chairman Chung Mong-koo, there should be no problem generating the necessary funds.”

Won-Joo Lee takeoff@donga.com

![하버드 의사가 실천하는 ‘뇌 노화 늦추는 6가지 습관’ [노화설계]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/01/22/133210626.3.jpg)