MoneyStation: “The Path to Investment Success Lies in AI and Collective Intelligence”

MoneyStation: “The Path to Investment Success Lies in AI and Collective Intelligence”

Posted December. 27, 2024 10:37,

Updated December. 27, 2024 10:37

Investing in stocks, funds, bonds, and virtual assets involves endless decision-making. Many investors strive to access information faster and more accurately, to make rational decisions. However, verifying the relevance of such information and ensuring the correct decisions are made remains a challenge.

MoneyStation, led by CEO James Lee, is a company that is addressing this challenge by leveraging artificial intelligence (AI) technology and collective intelligence through social networks. By offering more logical data relationship analyses, MoneyStation enhances an investor's insights and strengthens the competitiveness of financial companies, ultimately helping its clients achieve higher returns. In an interview with CEO James Lee, we explore the company’s technology, expertise, and its growth potential.

Investment Information Shifting from Institutions to Individuals and Social Media

James Lee, CEO of MoneyStation, previously worked as a fund manager at a renowned asset management firm for a period of four years. He also has extensive industry experience from working at major securities companies and asset evaluation firms. After observing the shift taking place in investment information production, analysis, and sharing from traditional institutions (such as media, academia, and securities firms) to personalized tools and social media, he envisioned creating a media platform and investment analysis solution for individual investors. In 2018, he founded MoneyStation and its services were officially launched in 2019.

AI-based investment solution SignalEngine (left) and the investment social platform MoneyStation (right) / Source: MoneyStation

AI-based investment solution SignalEngine (left) and the investment social platform MoneyStation (right) / Source: MoneyStation

MoneyStation provides guidance for a diverse range of financial investments—including stocks, bonds, funds, and virtual assets—through the use of big data and content. Its main services include the MoneyStation platform designed for individual investors, and the SignalEngine AI-based investment solution for institutional clients such as securities firms, asset management companies, and banks.

AI Solution Adopted by Leading Financial Institutions: SignalEngine

SignalEngine has been adopted by various enterprises and institutions, including Samsung Securities, Woori Investment & Securities, Eugene Investment & Securities, IBK Securities, Industrial Bank of Korea, BNK Securities, iM Securities, DB Financial Investment, and Shinhan Securities, both in South Korea and in Vietnam. This AI solution enables individual users to access advanced analytical tools that were previously exclusive to institutional investors. CEO James Lee emphasized that the total monthly transaction volume facilitated by SignalEngine exceeds KRW 100 billion, while the solution is significantly contributing to improved client experiences and profitability for financial institutions.

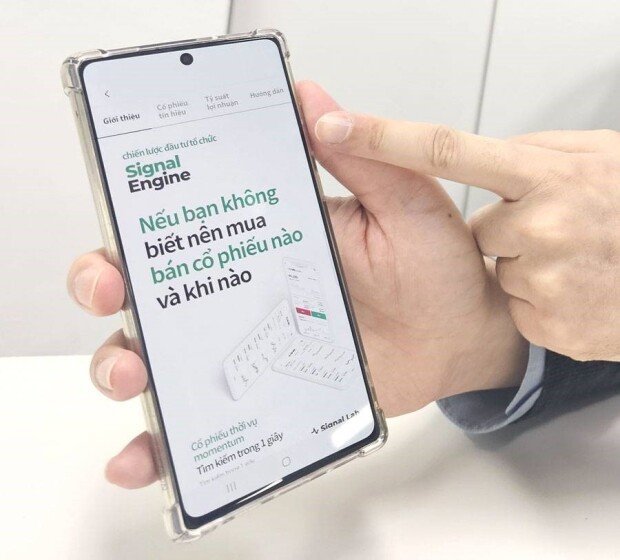

Moreover, the adoption of SignalEngine by major financial firms has facilitated MoneyStation’s entry into overseas markets. For instance, SignalEngine is prominently featured on the main interface of Shinhan Securities’ Vietnam branch, which has enhanced MoneyStation’s recognition and profitability in the region.

SignalEngine showcased via the Shinhan Securities Vietnam branch, as an entry to the Vietnamese market / Source: iT DongA

SignalEngine showcased via the Shinhan Securities Vietnam branch, as an entry to the Vietnamese market / Source: iT DongA

Additionally, MoneyStation reported that SignalEngine is being tested for use in institutional investment services by one of the largest hedge funds in Singapore. As Singapore is home to numerous hedge funds that have been relocated from Hong Kong, specializing in short-selling and derivatives trading, the capabilities of SignalEngine are perfectly aligned with the region’s financial activities. CEO Lee also revealed his plans to expand into the US market next year.

Investment Social Platform Growing with Financial Influencers

While SignalEngine has been gaining a significant amount of attention, the MoneyStation platform has also been steadily growing. Presently, the platform hosts over 100,000 pieces of accumulated content. Influential figures in the investment sector have taken on active roles, generating diverse and engaging content that embodies the collective financial intelligence, according to CEO Lee.

As its content offerings continue to grow, MoneyStation’s reach is expanding to external platforms. For example, its content is shared on securities-related apps and web services. “In the BNK Securities app, MoneyStation’s content is featured more prominently than that of major forums like Naver’s discussion boards,” Lee noted, again highlighting the growing recognition of MoneyStation’s value within the industry.

Integrating Social Media and Investment Functionalities

Looking ahead, CEO Lee envisions integrating the functionalities of MoneyStation and SignalEngine into a unified service. This will allow users to analyze quantitative financial big data through social media, while making investments directly. He also mentioned his plans to introduce new revenue models, including a subscription fee for premium content and commissions for investment products.

Business model enhancement plans through future service upgrades / Source: MoneyStation

Business model enhancement plans through future service upgrades / Source: MoneyStation

MoneyStation is also collaborating with Galaxia Metaverse, a blockchain-focused affiliate of Hyosung Group. Through this collaboration, MoneyStation’s AI-based big data analysis for virtual assets will be integrated into Galaxia Metaverse’s digital asset platform. This marks MoneyStation’s expansion into blockchain and virtual asset analytics.

Overcoming Challenges through Continuous Development and Exports

CEO Lee acknowledged the challenges the company has faced, particularly during the last three years, as rising interest rates have tightened the flow of venture capital. This environment has been especially detrimental to startups and small businesses.

“In a market where funding is scarce, many fintech startups have struggled to succeed. MoneyStation, however, has maintained its profitability and growth by diversifying the existing solutions and platforms, as well as expanding its capabilities across various asset classes, and focusing on exports,” Lee explained. “We are aiming for a global expansion as our next breakthrough.”

Satisfaction with SBA’s Support Programs

CEO Lee expressed his gratitude for the support that has been provided by SBA, which he described as instrumental in overcoming the company’s challenges. MoneyStation was selected to take part in SBA’s startup-corporate collaboration program, Open Innovation.

Through this program, the company received financial and logistical support, as well as opportunities to promote its business. Collaborations with globally active corporations, such as Shinhan Financial Group, enabled MoneyStation to pursue the international market. SBA also provided assistance with airfare for business trips and the production of promotional videos for overseas audiences. “I highly recommend SBA’s programs to startups that are aiming for global expansion,” Lee added.

by Young-woo Kim (pengo@itdnga.com)

MoneyStation, led by CEO James Lee, is a company that is addressing this challenge by leveraging artificial intelligence (AI) technology and collective intelligence through social networks. By offering more logical data relationship analyses, MoneyStation enhances an investor's insights and strengthens the competitiveness of financial companies, ultimately helping its clients achieve higher returns. In an interview with CEO James Lee, we explore the company’s technology, expertise, and its growth potential.

Investment Information Shifting from Institutions to Individuals and Social Media

James Lee, CEO of MoneyStation, previously worked as a fund manager at a renowned asset management firm for a period of four years. He also has extensive industry experience from working at major securities companies and asset evaluation firms. After observing the shift taking place in investment information production, analysis, and sharing from traditional institutions (such as media, academia, and securities firms) to personalized tools and social media, he envisioned creating a media platform and investment analysis solution for individual investors. In 2018, he founded MoneyStation and its services were officially launched in 2019.

MoneyStation provides guidance for a diverse range of financial investments—including stocks, bonds, funds, and virtual assets—through the use of big data and content. Its main services include the MoneyStation platform designed for individual investors, and the SignalEngine AI-based investment solution for institutional clients such as securities firms, asset management companies, and banks.

AI Solution Adopted by Leading Financial Institutions: SignalEngine

SignalEngine has been adopted by various enterprises and institutions, including Samsung Securities, Woori Investment & Securities, Eugene Investment & Securities, IBK Securities, Industrial Bank of Korea, BNK Securities, iM Securities, DB Financial Investment, and Shinhan Securities, both in South Korea and in Vietnam. This AI solution enables individual users to access advanced analytical tools that were previously exclusive to institutional investors. CEO James Lee emphasized that the total monthly transaction volume facilitated by SignalEngine exceeds KRW 100 billion, while the solution is significantly contributing to improved client experiences and profitability for financial institutions.

Moreover, the adoption of SignalEngine by major financial firms has facilitated MoneyStation’s entry into overseas markets. For instance, SignalEngine is prominently featured on the main interface of Shinhan Securities’ Vietnam branch, which has enhanced MoneyStation’s recognition and profitability in the region.

Additionally, MoneyStation reported that SignalEngine is being tested for use in institutional investment services by one of the largest hedge funds in Singapore. As Singapore is home to numerous hedge funds that have been relocated from Hong Kong, specializing in short-selling and derivatives trading, the capabilities of SignalEngine are perfectly aligned with the region’s financial activities. CEO Lee also revealed his plans to expand into the US market next year.

Investment Social Platform Growing with Financial Influencers

While SignalEngine has been gaining a significant amount of attention, the MoneyStation platform has also been steadily growing. Presently, the platform hosts over 100,000 pieces of accumulated content. Influential figures in the investment sector have taken on active roles, generating diverse and engaging content that embodies the collective financial intelligence, according to CEO Lee.

As its content offerings continue to grow, MoneyStation’s reach is expanding to external platforms. For example, its content is shared on securities-related apps and web services. “In the BNK Securities app, MoneyStation’s content is featured more prominently than that of major forums like Naver’s discussion boards,” Lee noted, again highlighting the growing recognition of MoneyStation’s value within the industry.

Integrating Social Media and Investment Functionalities

Looking ahead, CEO Lee envisions integrating the functionalities of MoneyStation and SignalEngine into a unified service. This will allow users to analyze quantitative financial big data through social media, while making investments directly. He also mentioned his plans to introduce new revenue models, including a subscription fee for premium content and commissions for investment products.

MoneyStation is also collaborating with Galaxia Metaverse, a blockchain-focused affiliate of Hyosung Group. Through this collaboration, MoneyStation’s AI-based big data analysis for virtual assets will be integrated into Galaxia Metaverse’s digital asset platform. This marks MoneyStation’s expansion into blockchain and virtual asset analytics.

Overcoming Challenges through Continuous Development and Exports

CEO Lee acknowledged the challenges the company has faced, particularly during the last three years, as rising interest rates have tightened the flow of venture capital. This environment has been especially detrimental to startups and small businesses.

“In a market where funding is scarce, many fintech startups have struggled to succeed. MoneyStation, however, has maintained its profitability and growth by diversifying the existing solutions and platforms, as well as expanding its capabilities across various asset classes, and focusing on exports,” Lee explained. “We are aiming for a global expansion as our next breakthrough.”

Satisfaction with SBA’s Support Programs

CEO Lee expressed his gratitude for the support that has been provided by SBA, which he described as instrumental in overcoming the company’s challenges. MoneyStation was selected to take part in SBA’s startup-corporate collaboration program, Open Innovation.

Through this program, the company received financial and logistical support, as well as opportunities to promote its business. Collaborations with globally active corporations, such as Shinhan Financial Group, enabled MoneyStation to pursue the international market. SBA also provided assistance with airfare for business trips and the production of promotional videos for overseas audiences. “I highly recommend SBA’s programs to startups that are aiming for global expansion,” Lee added.

by Young-woo Kim (pengo@itdnga.com)

Headline News

- Acting president fills key court vacancies, opposition cries foul

- Graham Allison raises alarm over 'Thucydides Trap' as U.S.-China tensions rise"

- Samsung posts 6.6 trillion won operating profit in Q1

- Chinese teens caught filming Air Force jets without authorization

- S. Korea’s early presidential election set for June 3