Stock accounts for minors double for the past year

Stock accounts for minors double for the past year

Posted February. 19, 2021 07:29,

Updated February. 19, 2021 07:29

In October 2019, Ahn Bo-bae, 35, opened a stock account and bought two stocks of Samsung Electronics for her 10-year-old son because he said he wanted to try investing after reading articles about stock markets in newspapers for kids. “I thought about waiting until he grows up,” said Ahn. “But I decided that investing his savings would help him learn about the economy.” Although Ahn and her husband explain stock market jargon and concepts to their son, they let him decide when to sell what. He handed over 82,000 to them to buy a Samsung Electronics’ stock late last month as the price dropped to just over 80,000.

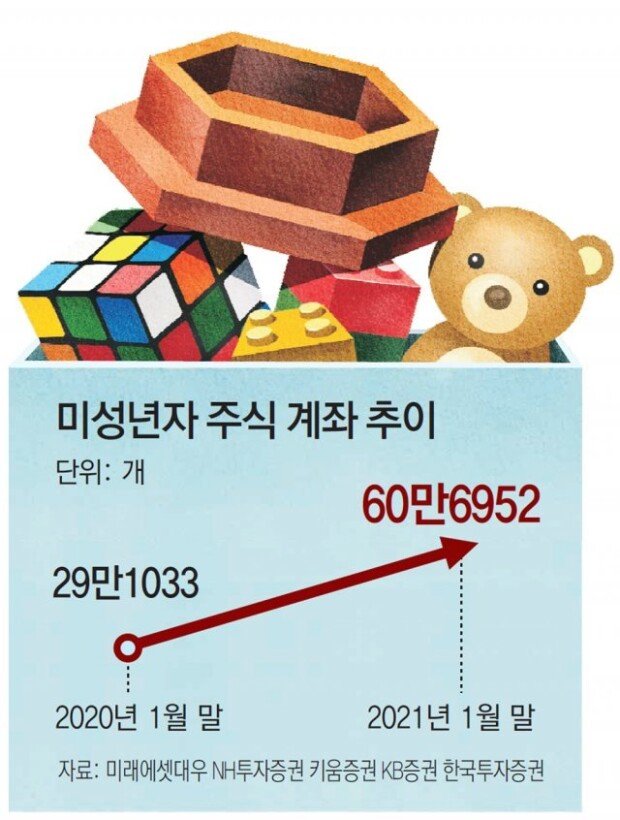

Statistics show that stock accounts for minors under the age of 19 have more than doubled within a year amid growing popularity of investing in the nation.

According to the financial investment industry, as of Thursday, KIWOOM Securities, Mirae Asset Daewoo, NH Investment & Securities, KB Securities, and Korea Investment & Securities had the combined number of 606,952 stock accounts that belonged to minors, 108.6 percent up from 291,033 in 2020. In January when KOSPI exceeded 3,000 points, more than 80,000 accounts were opened. There were fewer than 10,000 new accounts that were opened for minors in 2019.

It appears that growing interest in booming stock markets and increasing awareness among parents of the importance of financial investments have resulted in such a high number of minors with stock accounts. There are also more parents who give stocks to their children who are faced with stiff challenges such as soaring housing prices and decreasing job opportunities. “Allowing teenagers to make small investments can help them become financially literate,” said Han Jun-gyeong, an economics professor at Hanyang University. “There are, however, risks of illicit gifting with large investments.”

Hee-Chang Park ramblas@donga.com

![“잠만 자면 입이 바싹바싹”…잠들기 전에 이것 체크해야 [알쓸톡]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/23/133404749.3.jpg)

![[단독]“학업 위해 닷새전 이사왔는데”…‘은마’ 화재에 10대 딸 참변](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/24/133414074.1.jpg)