China's real estate crisis poised to spread

China's real estate crisis poised to spread

Posted September. 21, 2022 07:59,

Updated September. 21, 2022 07:59

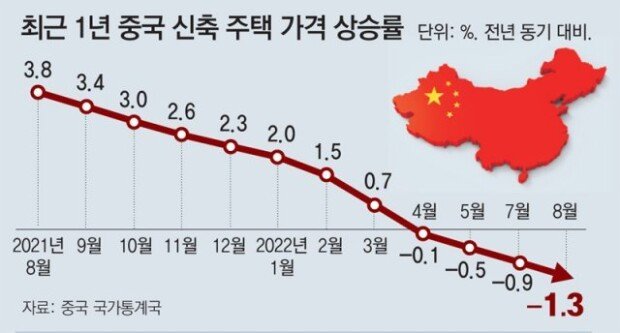

Concerns are rising globally as the economic crisis triggered by the real estate recession in China is likely to spread worldwide. Citigroup said on Monday that China's private-owned and state-owned enterprises are faced with bankruptcy. That, in turn, is raising potential risks for the banks in China which financed them. China's real estate industry accounts for 25 percent of the country's GDP. Some forecast that South American nations whose exports depend on China by 30 to 40 percent and even the U.S. may be hit if the property market recession spills over to the overall economy of China. The Bank of America warned that the U.S. might encounter a supply chain crisis set off by China.

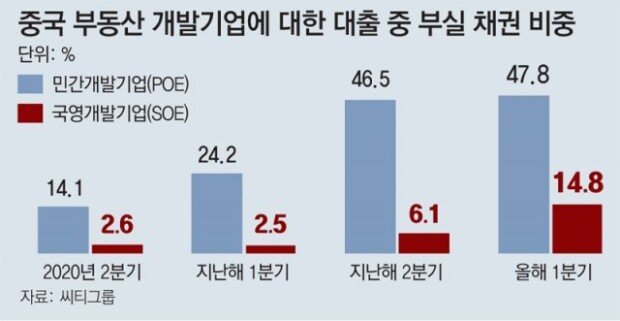

Citigroup estimated that some 7.6 trillion U.S. dollars were taken out as loans in China's real estate market for the first half of the year, noting that 29.1 percent or about 3,075 trillion Korean won worth loans were analyzed as non-performing.

According to Bloomberg on Tuesday, people in 119 Chinese cities who won new apartment lotteries were refusing to repay their bank loans for the house until their apartments are fully built.

Chinese banks are at the risk of not getting their money back from both the construction companies and the people who took loans for their housing lotteries. Citigroup pointed out that the size of non-performing loans is getting bigger in China's 52-trillion-US dollar worth property market.

Some analyze that the non-performing loan ratio may be more significant than reported. S&P Global Ratings cautioned that the banks in China might lose some 350 billion U.S. dollars. "China has reached a point of no return in its battle to contain what could be the biggest property crash the world has ever seen,” The Guardian said. “It is a perilous moment for the country’s Communist leadership and the global economy."

Eun-Taek Lee nabi@donga.com

![[단독]임성근, 4차례 음주운전 적발…99년 집행유예 기간 중 무면허 음주 적발](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/01/20/133195400.1.png)

![“한동훈, 정치생명 걸고 무소속 출마해 평가받는 것 고려할만”[정치를 부탁해]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/01/19/133186982.1.jpg)