S. Korean household debt reached No. 2 among major countries

S. Korean household debt reached No. 2 among major countries

Posted July. 18, 2023 08:13,

Updated July. 18, 2023 08:13

South Korea’s household debt amount and increasing speed last year were the second highest among major countries.

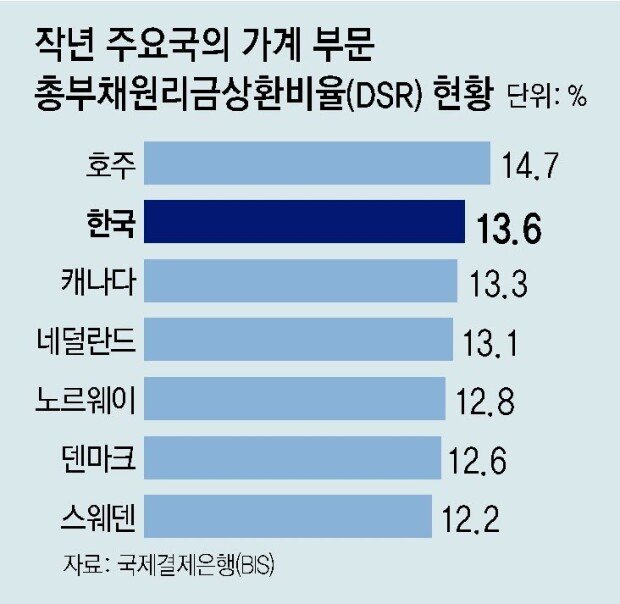

According to the Bank for International Settlements (BIS) on Monday, South Korea’s household debt service ratio (DSR) recorded 13.6 percent last year, which is second highest after Australia with 14.7 percent among 17 countries included in the research. The DSR is the ratio of annual principal and interest payments divided by annual income. A higher DSR means a heavier burden to repay debt. The BIS uses the national accounts of 17 major countries to calculate quarterly DSR.

South Korea’s household debt increased at the second fastest pace. The country’s DSR increased by 0.8 percentage points last year compared to 12.8 percent in 2021, which is the second biggest jump, following 1.2 percentage points in Australia during the same period. While more than half of the 17 countries experienced a decrease in DSR and stabilized household debt, South Korea experienced an unusually fast pace of household debt increase.

The main cause of such a fast DSR increase in South Korea is the rapid interest rise during the recent two years. As the Bank of Korea raised base rates to deal with high inflation, household debt interest rates rose from 3.01 percent in 2021 to 4.66 percent in 2022.

Compared to the economic size, South Korea’s total household debt is also very high compared to other major countries. According to the report published by the Bank of Korea on Monday, South Korea’s household debt ratio versus its GDP is 105.0 percent as of the end of last year, which is the third highest figure, following Switzerland with 128.3 percent and Australia with 111.8 percent among 43 major countries. Lately, household debts from banks are increasing at a fast pace as base rates are frozen, and the real estate market shows signs of a rebound.

Governor of the Bank of Korea Rhee Chang-yong said in a recent press conference that if household debts increase sharply to an unexpected level, the bank will deal with it by adjusting interest rates or imposing macroprudential regulations.

dhlee@donga.com · abro@donga.com

![월 800만 원 버는 80대 부부 “집값만 비싼 친구들이 부러워해요”[은퇴 레시피]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/13/133363096.4.jpg)