Fed is expected to raise the rate to 5 percent next year

Fed is expected to raise the rate to 5 percent next year

Posted December. 16, 2022 07:40,

Updated December. 16, 2022 07:40

Although the Fed has slowed down the pace of raising interest rates unprecedentedly fast, it has only temporarily taken its foot off the clutch of austerity measures and did not step on the brake. The speed may have slowed down, but the Fed made clear its intention to hike interest rates next year. With the Fed’s upward adjustment of the target benchmark interest rate to 5 percent or even higher, Korea’s interest rate is likely to rise above the previously expected 3.5 percent.

At the FOMC meeting on Wednesday, the Fed raised interest rates by 0.5 percentage points to 4.25 to 4.5 percent, the highest rate in 15 years since October 2007, when the interest rate was 4.75 percent. It was a smaller increase than in recent announcements of raising interest rates by 0.75 percentage points.

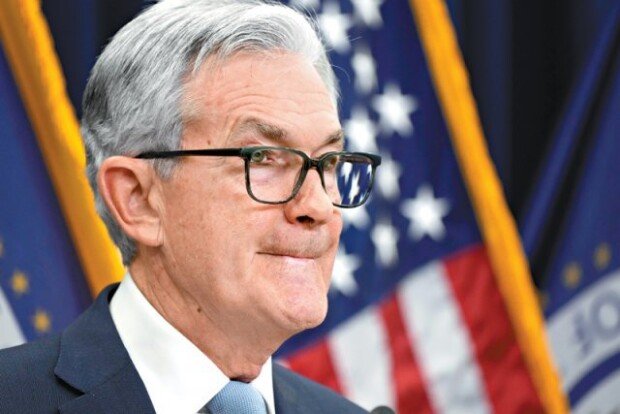

Although the pace has been slowed down, Federal Reserve Chairman Jerome Powell gave hawkish hints in his statement. “We still have some ways to go,” Mr. Powell said. “The inflation data received so far in October and November show a welcome reduction in the pace of price increases, but it will take substantially more evidence to give confidence inflation is on a sustained downward path,” he said. “The Fed will need to see a few more signs over a longer time frame that inflation is under control before a full pivot,” Powell said, pushing back against the markets’ expectations of a Fed pivot.

Chairman Powell’s remarks were encapsulated in the FOMC’s so-called dot plot, a chart that shows the Fed’s projections of rate moves over the next few years. The average number of the terminal rate projected by 19 FOMC members was 5.1 percent, 0.5 percentage points up from the projection in September, which stood at 4.6 percent. This means there is a high chance that the Fed might raise interest rates by another 0.75 percentage points.

The Fed’s big step widened the interest rate gap between Korea and the U.S. to 1.25 percentage points, the biggest in 22 years. The market earlier expected that the Bank of Korea would raise the interest rate by 0.25 percentage points to 3.5 percent in January 2023 and suspend the rate hike. However, if the Fed raises the rates to 5 percent, the rate gap between Korea and the U.S. will be widened to 1.5 percent, the widest rate gap in history. This will increase the volatility of the foreign exchange market, and the Bank of Korea will be compelled to raise the rate higher.

Min-Woo Park minwoo@donga.com