Buffett dubs U.S. stock market as ‘gambling parlor’

Buffett dubs U.S. stock market as ‘gambling parlor’

Posted May. 02, 2022 08:00,

Updated May. 02, 2022 08:00

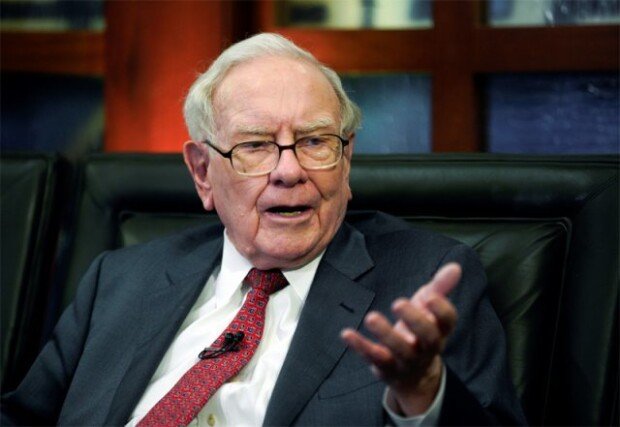

Berkshire Hathaway CEO and founder Warren Buffett, also known as the Oracle of Omaha, spoke critically of Wall Street in an offline shareholder meeting held in three years. He said that Wall Street has turned into a gambling parlor swarming with speculative investors coaxed by Wall Street financial businesses into seeking short-term profits.

Buffett criticized Saturday in the latest shareholder meeting of the Omaha-based company in the midwestern region of Nebraska in the United States that stock market investors are encouraged by Wall Street to think of companies as “poker chips.” He denounced the U.S. financial market as a de-facto “casino.” Bringing up a growing use of derivatives such as call options that benefit financial businesses greatly but put individual investors at risk, he said, “Wall Street makes money, one way or another, catching the crumbs that fall off the table of capitalism. They don’t make money unless people do things, and they get a piece of them. They make a lot more money when people are gambling than when they are investing.” This caused large companies to be relegated to chips on the gambling table, he explained.

Buffett made it clear that he takes a negative stance against the incorporation of cryptocurrencies such as bitcoin into mainstream investment portfolios on Wall Street. He argued that Bitcoin is not a productive asset, adding, “It doesn’t produce anything. It’s got a magic to it and people have attached magics to lots of things.” He explained that farmland produces food ingredients and apartment buildings give owners rental income but all investors can do with bitcoin is sell it to others. Berkshire Hathaway Vice Chairman Charlie Munger, Buffett’s right-hand man, supported this viewpoint, saying, “In my life, I try to avoid things that are stupid and evil and make me look bad...and Bitcoin does all three.”

Buffett announced that he spent more than 51 billion dollars on stocks in the first quarter of this year, revealing that he bought stocks of U.S. energy companies such as Chevron and Occidental Petroleum while he purchased 9.5 percent of video gaming business Activision Blizzard. Berkshire saw a 1.6-billion-dollar loss in stock investment in this year’s first quarter, only earning 5.4 billion dollars, 53 percent down on a year-on-year basis. Buffett’s start power is still strong enough although some shareholders wish to see Buffett leave due to disappointing figures, reported The Wall Street Journal.

newsoo@donga.com

![“잠만 자면 입이 바싹바싹”…잠들기 전에 이것 체크해야 [알쓸톡]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/23/133404749.3.jpg)