Oil shock poised to disrupt Korea’s trade balance

Oil shock poised to disrupt Korea’s trade balance

Posted March. 29, 2022 07:49,

Updated March. 29, 2022 07:49

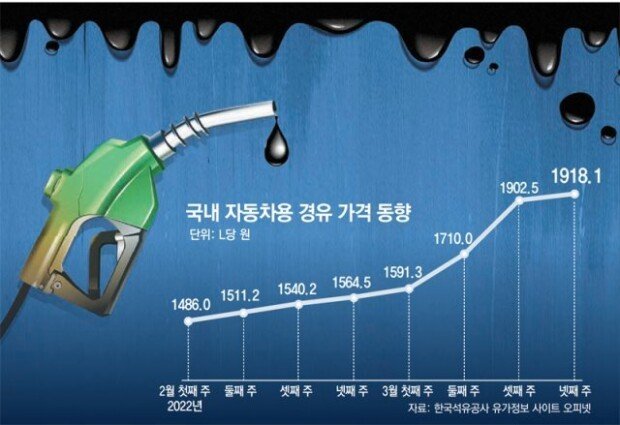

With the spike in international oil prices, the prices of diesel frequently used by ordinary folks are also soaring following the uptick of gasoline prices. The imports of energy have surge as well, boding ill for trade, the engine of the South Korean economy.

The spikes of both gasoline and diesel prices are heavily weighing down on the lower-income families and distribution businesses. According to Opinet, a local provider of oil prices, the average per liter price of gasoline stands at 2,001.15 won, that of diesel at 1,920.44 won. Some parts of the country are even witnessing the diesel selling at more expensive prices than gasoline.

The upward momentum of diesel prices was fueled after the U.S. banned the imports of Russian crude oil. As Russia is accountable for 60% of all European diesel imports, the bottleneck of supply has instantly catapulted the international diesel prices to the sky.

In some cases, the prices of diesel are even higher than those of gasoline as the latter enjoys a bigger margin of fuel tax cut. In South Korea, gasoline is slapped with a fuel tax worth 820 won per liter before the tax cut, and diesel tax is 582 won per liter. This means when the fuel tax is cut by 20%, gasoline gets cheaper by 164 won and diesel by 116 won.

Against the backdrop of skyrocketing diesel prices, seven local organizations of distribution from taxi, bus to truck filed a joint statement with the government, urging for a practical measure to address the increase in oil prices. The organizations complained, arguing the diesel prices have jumped by 80% over the past three years from the lowest, dampening the operating profits of distribution businesses. In the statement, the organizations requested that the cut of the subsidies pegged to fuel taxes should be restored to their entirety, and the burden of oil expenses must be alleviated by implementing subsidies pegged to oil prices.

With a logistical nightmare becoming imminent, the government is considering the measure of increasing the fuel tax cut from 20% to more. The maximum cut allowed by the current law is 37%. A high-ranking official from the finance ministry said, they are debating hard whether it should be 25% or 30%.

The increase in crude oil imports can translate into a higher import cost for local businesses, posing a threat to trade, the last resort of the South Korean economy. Indeed, South Korea posted 5.98 billion won in trade deficits as of March 20. Last year, the country posted a 6.66 billion won in trade surplus during the same period.

“Given the trajectory of international oil prices, a trade deficit seems to be a real possibility,” said Joo Won, the head of economic research department at Hyundai Research Institute. “If the current trend continues, Korea’s trade balance might turn red within the first half of this year, and even if it manages to post a surplus, the amount would be meagre compared to last year.”

kalssam35@donga.com