US signals quantitative tightening following early interest raise

US signals quantitative tightening following early interest raise

Posted January. 07, 2022 07:40,

Updated January. 07, 2022 07:40

The U.S. Federal Reserve System (Fed) announced a plan for a more aggressive tightening than what’s been known previously to address inflation concerns. As the Fed not only introduces earlier and faster interest raise and reviews quantitative tightening, which directly retrieves the money from the market, it will have a significant impact on the global financial crisis and economy.

“Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated,” the minutes of the Federal Open Market Committee meeting held on Dec. 14 and 15 last year said. The minutes were released on Wednesday (local time). “Almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate.” It means the Fed will sell bonds purchased through quantitative easing to the market to further tighten money. Currently, the Fed holds 8.8 trillion dollars in assets. The Wall Street Journal predicted that the Fed will raise interest rate in March.

Due to concerns about quantitative tightening, the New York Stock Exchange had a sharp fall and the interest rates of the U.S. government bonds rose. The Dow Jones Industrial Average and the Standard & Poor's 500 Stock Index fell 1.07 percent and 1.94 percent, respectively, from the previous day. In particular, NASDAQ Composite Index, which is largely composed of technology stocks sensitive to the interest rate rise, fell 3.34 percent.

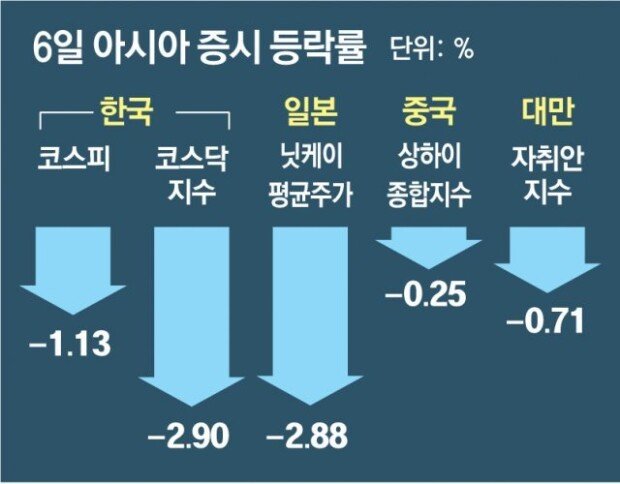

The stock markets of major Asian countries, including South Korea, also fell on Thursday and Asian currencies’ values against U.S. dollar also dropped. The KOSPI of South Korea closed at 2920.53 points on Thursday, 1.13 percent lower than the previous day. The won-dollar exchange rate rose 4.1 won to 1201.0 won. It was the first time in 1.5 years since July 24, 2020 when the closing exchange rate went up beyond 1,200 won.

jarrett@donga.com · payback@donga.com

![연금 개시 가능해지면 年 1만 원은 꼭 인출하세요[은퇴 레시피]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/20/133390850.4.jpg)

![취권하는 중국 로봇, ‘쇼’인 줄 알았더니 ‘데이터 스펀지’였다?[딥다이브]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/02/20/133391101.1.png)