BOK raises benchmark interest rate from 0.75% to 1%

BOK raises benchmark interest rate from 0.75% to 1%

Posted November. 26, 2021 07:36,

Updated November. 26, 2021 07:36

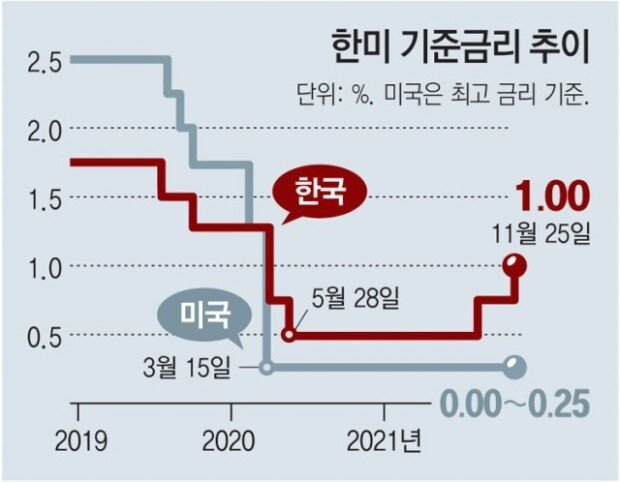

South Korea’s benchmark interest rate, which has been staying at near zero since March last year in the face of COVID-19 crisis, has finally come to its end in 20 months. The Bank of Korea announced that it would raise interest rate to 1%, following the rate hike by 0.5 percentage points in the course of the past three months. Debt repayment burdens for households are expected to go up, as the central bank implied a further interest rate hike in the first quarter of 2022.

The Bank of Korea held the Monetary Policy Board meeting on Thursday and raised the base rate by 25 basis points, from 0.75% to 1%. The rate hike came three months after the BOK raised the rate up in August for the first time since the outbreak of the COVID-19 pandemic, returning to the 1% range in 20 months since March last year.

Bank of Korea Governor Lee Ju-yeol said in the press briefing held immediately after the Monetary Policy Board meeting, and cited the bigger-than-expected inflationary pressure and concerns of financial imbalances as the drivers of the rate increase. The BOK also adjusted upward its projection of the YoY increase of the consumer price index from 2.1% to 2.3% and its forecast of price hike for 2022 from 1.5% to 2.0%.

Governor Lee said that base rate of 1% is still dovish and that the latest rate hike would not adversely impact, but rather support, the real economy, considering the economic growth and inflation of 2022. “It depends on the economic circumstances in the first quarter of 2022 to determine whether a further rate hike is necessary,” said Gov. Lee, suggesting the possibility of an additional rate increase.

As the latest series of rate hikes are expected to accelerate an increase of borrowing rates, those who have taken out excessive loans to make aggressive investment are likely to be dealt with a heavy blow. The marginalized and zombie companies, including small business owners and heavy debtors, would be directly hit by the rate hike. The South Korean central bank estimated that the rate hike to 1% by the end of this year would increase the debt repayment burden for households up to 5.8 trillion won a year.

Hee-Chang Park ramblas@donga.com

![[속보]“하메네이 아들, 이란 차기 최고지도자로 선출”](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/03/04/133459477.1.jpg)

![매일 반복하는 이 습관, 동맥을 야금야금 망가뜨린다[노화설계]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/03/03/133455012.3.jpg)