Will KIKO Dispute Face a Turning Point?

Will KIKO Dispute Face a Turning Point?

Posted August. 21, 2010 14:32,

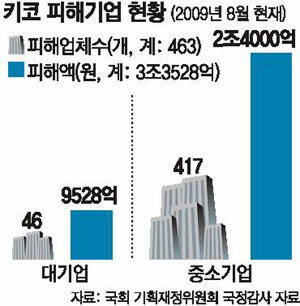

The Financial Supervisory Service has decided to punish executives and employees of banks that sold the currency option knock-in, knock-out, or KIKO, possibly signaling a turning point in disputes that have lasted more than two years.

The disputes began in June 2008 when companies affected by KIKO asked the Fair Trade Commission to review the terms of KIKO and legitimacy of currency option contracts. This led to a host of lawsuits, with 118 companies undergoing litigation.

Of the lawsuits, just one was concluded with Soosan Heavy Industries losing its case against Citi Bank and Woori Bank in February. Prior to this, the commission rejected a request of reviewing KIKO terms.

This development caused the financial sector to believe that the commission and the court found no problems in the currency option and their sale processes.

The financial watchdogs decision, however, gave affected companies high hopes of winning their cases since the decision was made under the recognition that banks were at fault in the process of selling the currency option. Critics, however, say the government is helping banks absolve themselves of their responsibility by shunning key issues that can affect court rulings.

○ Banks violating regulations excluded from disciplinary action

The Financial Supervisory Service Thursday took disciplinary measures against 72 executives and employers of nine banks. It conducted three investigations into the banks that sold the currency option from August 2008 to February last year, and found violations in the process of selling the products.

The banks are known to have sold KIKOs whose contract amounts were larger than the expected export-import volumes of a company (over-hedge) or transferred existing contracts into new ones without adjusting the losses a company suffered from existing contracts (loss transfer transactions).

KIKO earns companies profits if foreign exchange rates fluctuate within set boundaries but causes losses if the rates exceed ceilings. Many companies made KIKO contracts surpassing the amount of their expected export volumes in anticipation of falling currency rates. With the rates soaring in 2008, they suffered huge losses.

The watchdog fostered controversy, however, by excluding banks that did over-hedging or made loss transfer transactions from disciplinary measures,

The watchdog said KIKO contracts exceeding 125 percent of the expected export volume are in violation of regulations, but excluded banks from disciplinary action if they presented rational reasons for the excess in the process of the investigation.

The watchdogs decision to hold accountable banks that made loss transfer transactions after July 2008 also invited resistance from the affected companies.

The watchdog punished six banks for over-hedging and one bank for loss transfer transactions.

○ Affected companies resist financial watchdogs decision

The possibility of disciplinary action creating unfavorable conditions for banks cannot be ruled out. If a bank is punished for over-hedging or loss transfer transactions, affected companies can legitimately claim that the bank failed to inform them of expected losses, experts say.

If a bank abused its dominant position to coax smaller companies into over-hedging or failed to inform of the risks of KIKO contracts, the bank will be in trouble.

The key issue is if affected companies can present evidence to back their claims in court. Given that the watchdog excluded the unfair sales practices of banks and the problem of KIKO products from the investigation, affected companies should present evidence of banks unfair practices to the court. If not, they will not see favorable court rulings, experts said.

A financial supervisory official said, If clear flaws by the banks are shown, the affected companies are likely to win the case, adding, But affected companies will find it difficult to prove that the banks were at fault since they lack material evidence unlike banks that log most transactions in detail.

All this has prompted affected companies to criticize the watchdog, saying the Financial Supervisory Service took light disciplinary action by avoiding sensitive issues.

A joint countermeasures committee of the affected companies told reporters Friday, The Financial Supervisory Services disciplinary action effectively ignored the responsibilities of banks by excluding major items in its investigation, adding, We will consider suing the Financial Supervisory Service governor and request a parliamentary investigation.

weappon@donga.com