China CPI drop could cast dark clouds over S. Korea

China CPI drop could cast dark clouds over S. Korea

Posted August. 10, 2023 08:24,

Updated August. 10, 2023 08:24

China’s consumer prices, a barometer of economic sentiment, fell for the first time in two years and five months. Looking at the worrying combination of the country’s declining prices and shrinking consumer confidence, some experts assume that the Chinese economy has already slid into deflation. With an increasingly bleak possibility of the world’s factory reinvigorating the global economy following the pandemic, South Korea - a market with high trade dependency on China - also feels a growing sense of crisis.

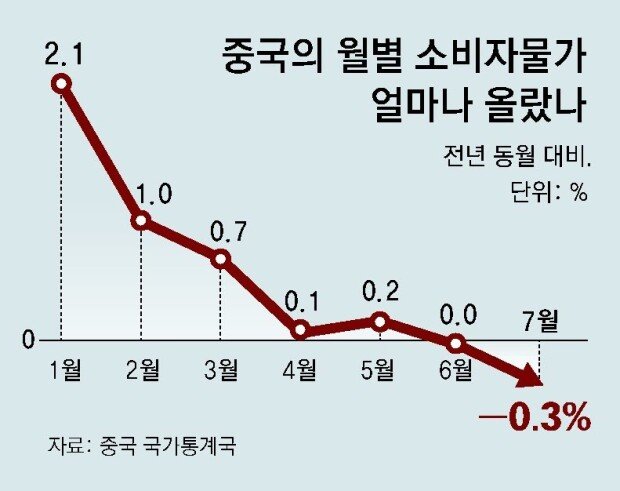

The National Bureau of Statistics of China announced on Wednesday that the country’s consumer price index (CPI) dropped 0.3 percent in July compared to one year ago. The index saw negative growth for the first time in two years and five months since its monthly CPI fell by 0.2 percent in February 2021. Recording 2.1 percent in January, it remained at less than one percent for four months running from March to drop to as low as zero percent in June.

The country’s producer price index (PPI), or a leading index of CPI that is measured to monitor prices, dropped 4.4 percent, going downward for 10 consecutive months. It is the first time for China to show negative growth in both CPI and PPI since November 2020.

Although the Chinese government has since last month put forward a pump-priming policy package to boost consumption of durables such as automobiles, furniture, and electronics and draw private-sector investment, it still appears to have a long way to go to enhance consumer confidence.

“It is only a temporary trend because prices rose significantly last July,” said China’s statistics agency, adding that they will gradually increase. Bloomberg News, however, analyzed that unlike the temporary drops in CPI earlier in 2021 amid the COVID-19 situation the recent falling prices involve serious issues because long-term factors are at play, such as the country’s shrinking demand and depressing real estate market. It decided that signs of deflation were already evident across the Chinese economy.

Experts agree that the slowing Chinese economy can negatively affect South Korea for some time. “The South Korean government’s expectations of an economic recovery are based on better figures in demand and exports,” said Joo Won, director of the Hyundai Research Institute. “Unfortunately, China’s slowing market only makes things hard on South Korean exporters.”

kalssam35@donga.com