Burden rises by 12trillion won in 3% interest rate era

Burden rises by 12trillion won in 3% interest rate era

Posted October. 13, 2022 08:00,

Updated October. 13, 2022 08:00

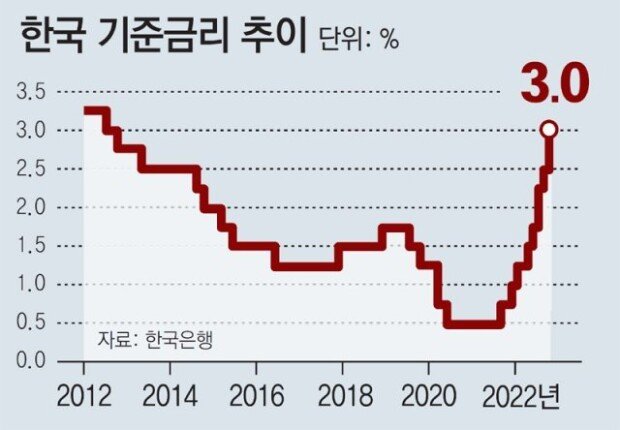

To tame strong inflations, the Bank of Korea (BOK) took another “big step” and raised the base rate by 0.5 percentage points to 3 percent, the highest since October 2012. The second big step translates to over 12 trillion won more interest burden on households and enterprises.

The central bank’s Monetary Policy Board held a meeting on Wednesday to discuss the future direction of their policy and decided to raise the policy rate by 0.5 percentage points to 3 percent. The central bank took its first big step in July, and it seemed to have been pacing the speed of interest hike by raising only 0.25 percentage points in August. This time, however, the Bank of Korea chose to enlarge the range of hikes again.

The BOK factored in the still-strong pressure from inflation for their second big-step decision. The Monetary Policy Board announced that it decided on a strong policy response, which was necessary due to persistent inflation, strong dollars pushing the price up, and increasing risk in the foreign exchange rate.” While the inflation has been slightly declining for two consecutive months from 6.3 percent since July, it is still at the mid-five percent level. The strong dollar, which exceeds the 1,400 won level, also pushes inflation further.

For these reasons, the interest rate hike is unavoidable. Yet, the higher rate means a much heavier interest burden to borrowers and enterprises. It will also discourage economic recovery with tightened consumption and investment. “The second big step will increase yearly interest burden on households and companies by 12 trillion won and lower the economic growth rate by 0.1 percentage point,” Governor of the BOK Lee Chang Yong stated during a media briefing. The exchange rate closed at 1,424.9 won against a dollar on Wednesday, down by 10.3 won from Tuesday, affected by the big step announcement.

Min-Woo Park minwoo@donga.com

![[단독]“두건 쓴 무장경비대 길목마다 검문…택시로 20시간 달려 탈출”](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/03/05/133470282.1.jpg)