Fed chairman leaves the door open for another rate increase

Fed chairman leaves the door open for another rate increase

Posted March. 09, 2023 07:43,

Updated March. 09, 2023 07:43

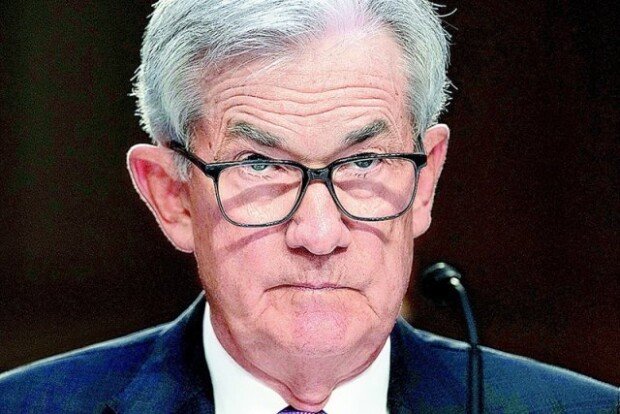

The global financial market stumbled on Wednesday after Federal Reserve Chairman Jerome Powell’s hawkish speech signaled another “big step” rate hike. All three major U.S. stock indexes nosedived, with the yield curve inversion widened the most in 42 years. The Kospi lost more than 1 percent, and the won-dollar exchange rate sharply rose to 1,320 won.

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” the U.S. central bank chief said in his semi-annual testimony before the Senate Banking Committee on Wednesday. “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes,” Powell said. He noted that “there is little sign of disinflation” when it comes to the important category of services spending excluding housing, food, and energy.

Market expectations for slowdown in rate hikes, following the Fed’s ‘baby step’ of 0.25 percentage point hike back in February, were not met. Instead, concerns are rising that the Fed will tighten monetary policy with the expectation of a 75 basis-point rate hike in the upcoming Federal Open Market Committee meeting scheduled on March 21 and 22. The steep rate hike will likely cause a global economic recession.

The comments by the Fed chairman pushed the U.S. Treasury yield curve below 1 percentage point, indicating a coming recession. The U.S. stocks fell more than 1 percent, and the Kospi closed at 2,431.91 points, down 31.44 points by 1.28 percent.

Min-Woo Park minwoo@donga.com