Gross real estate taxes may double as posted prices exceed actual transaction prices

Gross real estate taxes may double as posted prices exceed actual transaction prices

Posted November. 17, 2022 07:43,

Updated November. 17, 2022 07:43

While real estate prices are sharply decreasing in Jamsilbon-dong, Songpa-gu, Seoul with apartment units transacted at lower prices than their posted prices, this year’s gross real estate taxes have not reflected such price decreases. While the South Korean government announced measures to offer special exemptions for units worth up to 1.4 billion won and reflect last year’s posted prices to reduce excessive gross real estate taxes, the r National Assembly has not passed the relevant bill. When the bills for the taxes are sent on Tuesday, relevant taxpayers’ resistance to tax will grow.

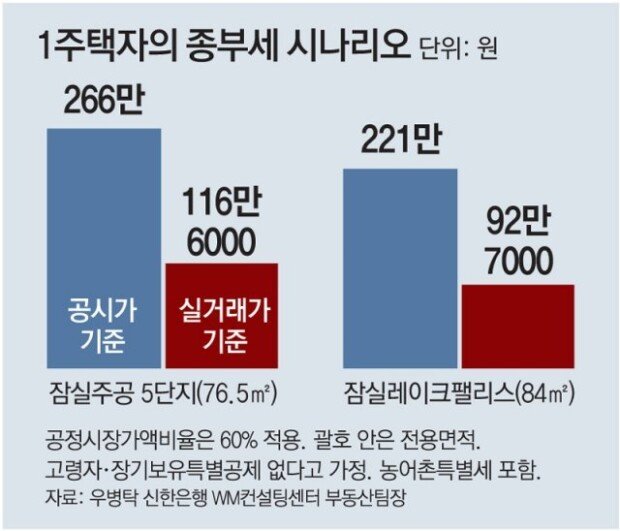

According to the analysis conducted by Woo Byung-tak, a team leader at Shinhan Bank’s WM Consulting Center, on the request of The Dong-A Ilbo, a resident and owner of the first-floor unit in the Jamsil Jugong Apartment Complex 5 with 76.5 square-meter for exclusive use who does not own any other real estate is expected to pay the gross real estate tax of 2.66 million won this year, including special tax for rural areas. The figure was estimated based on the unit’s posted price announced earlier this year, assuming no tax deductions, such as those for seniors and special long-term holding.

There was a recent case in the apartment complex in which a first-floor unit of the same size was sold at 1,908.5 million won, which is lower than its posted price of 1,937 million won. If recalculating gross real estate tax based on the actual transaction price of 1,908.5 million won, it is reduced by 56.1 percent to 1.166 million won. Applying the posted price realization rate of 81.2 percent for an apartment unit over 1.5 billion won, its posted price decreases to 1.55 billion won, which drastically decreases gross real estate tax. However, as posted prices reflect the majority transaction prices and the prices of units on the market, rather than a few transactions made at lower prices, the actual posted price to be announced next year may differ from the calculated amount.

This year’s gross real estate taxes are high because they are calculated based on the posted prices of last year, which saw a peak in the real estate market. This year’s posted prices of apartment units across the country are 17.2 percent higher than last year’s figures. The number of people subject to the payment of taxes this year is about 1.2 million, which exceeded one million for the first time in history, with the total gross real estate tax amount of four trillion won. This year’s price decreases will be reflected in next year’s posted prices.

The South Korean government is pursuing a measure to raise the gross real estate tax exemption bar from the current 1.1 billion won to 1.2 billion won for single-home owners next year to reduce people’s tax burden. However, the composition of the National Assembly's Strategy and Finance Committee's taxation sub-committee was completed on Wednesday, 118 days after the 21st National Assembly for the second half of the year was composed in July this year.

herstory@donga.com · 9dragon@donga.com

![범퍼에 고라니 낀 줄도 모르고…버젓이 주차한 운전자[e글e글]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2025/12/11/132946797.3.jpg)