US’s export control of semiconductor equipment to China has biggest impact on S. Korea

US’s export control of semiconductor equipment to China has biggest impact on S. Korea

Posted April. 09, 2024 07:33,

Updated April. 09, 2024 07:33

Since the U.S. imposed an export ban on cutting-edge semiconductor equipment to China in October 2022, it has significantly impacted South Korea among the major semiconductor equipment manufacturers. Even though most equipment that is manufactured by South Korean companies and exported to China is legacy equipment, which is not included under the regulation, South Korea saw an over 20 percent decrease in its exports compared to 2022. It is the result of China’s exclusion of South Korean equipment, which is technologically sub-par compared to the equipment made in countries with more advanced technologies when China preemptively bought equipment in preparation for the potential expansion of the U.S.’s regulations.

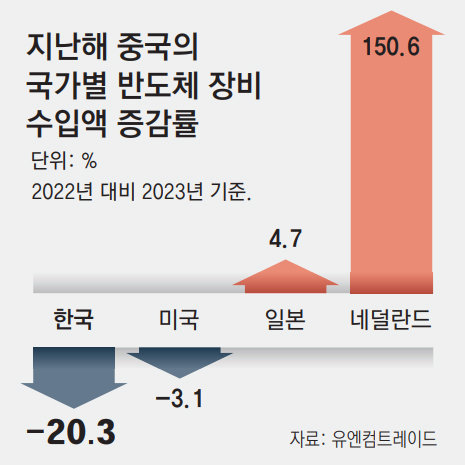

According to The Dong-A Ilbo’s Monday research into China’s semiconductor equipment import last year based on the U.N. trade statistics, the country’s import of South Korean equipment decreased by 20.3 percent compared to 2022 from 5.61 billion dollars to 4.47 billion dollars. It analyzes 19 HS codes relevant to semiconductor equipment, such as exposure, cleaning, etching, deposition, and testing.

During the same year, China’s import of U.S. equipment only decreased by 3.1 percent from 9.55 billion dollars to 9.25 billion dollars.

The country’s imports of equipment made in Japan and the Netherlands increased. The import of Japanese equipment rose 4.7 percent from 1.56 million dollars to 1.64 million dollars. The import of Dutch equipment saw a significant increase of 150.6 percent from 3.22 billion dollars to 8.07 billion dollars.

Such differences between countries stemmed from the fact that China has reduced the import of South Korean equipment, which is easily to be replaced by Chinese equipment, since the U.S.’s export ban was imposed. Some point to the fact that South Korean equipment was pushed down in priority when China was stocking up equipment because of the concerns about the expansion of the U.S.’s export ban from cutting-edge equipment to legacy equipment. Another contributing factor was the passive attitude of Samsung Electronics and SK hynix regarding the expansion and upgrade of their production lines in China.

박현익 기자 beepark@donga.com