The wrath of American ants starts a ‘short war’

The wrath of American ants starts a ‘short war’

Posted February. 01, 2021 07:38,

Updated February. 01, 2021 07:38

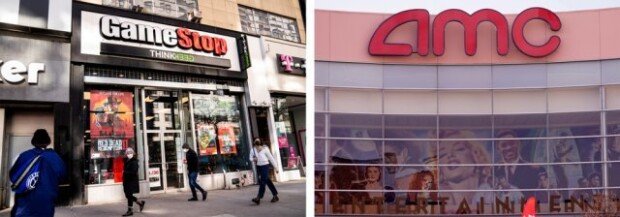

It is assessed that American retail traders called “Western ants” eagerly bought GameStop stocks against the short of Wall Street giants because of their relative deprivation and wrath due to the economic downturn and bipolarization due to COVID-19. Young investors are especially distraught due to unemployment and forced-eviction crises. Some analyze that they participated in the stock-buying to revenge the rich who became even richer amid the pandemic.

Well-known hedge funds Melvin Capital, which led the short of GameStop, has been recently criticized on U.S. online communities such as Reddit. “I vividly remember the shock of the 2008 financial crisis even though I was only in my early teens,” said an investor. “Melvin Capital symbolizes everything that I loathed at that time.” He emphasized that he bought GameStop stocks because of the financial pain that he and others suffered in the financial crisis.

Young investors who grew up with advanced information technology and are used to digital devises increase the influence of Western ants. The Wall Street Journal diagnosed that investors nowadays can trade stocks for free anywhere and anytime while in the past investors had to pay five percent or more of the trading amount as fees.

There were also supports from politicians. “For years, the same hedge funds, private equity firms, and wealthy investors dismayed by the GameStop trades have treated the stock market like their own personal casino while everyone else pays the price,” said Senator Elizabeth Warren, a hard-line liberal of the Democratic Party.

Jae-Dong Yu jarrett@donga.com

![‘건강 지킴이’ 당근, 효능 높이는 섭취법[정세연의 음식처방]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2026/01/18/133181291.1.jpg)