Loans from moneylenders plummeted by 82%

Loans from moneylenders plummeted by 82%

Posted May. 12, 2023 07:52,

Updated May. 12, 2023 07:52

Ms. A (aged 43), who owned three stores, including a side dish shop and a restaurant, turned to illegal private loan last year when she ran out of cash due to declining sales, as she was unable to borrow any more money from lawful financial services since she had already received 100 million won in business and credit loans. At first, she had decided to spend only 5 million won, but as her financial needs increased, she ended up using about 20 million won over a period of 10 months.

As the principal amount increased, the monthly payments continued to grow, and the total amount owed to the two illegal money lenders eventually reached 40 million won. "I have nowhere else to borrow money, and I didn’t have the money to pay the suppliers at the moment, so I ended up using illegal private loans, even though I knew the interest would be high," said Mr. A.

Small business owners who cannot borrow money from formal financial institutions are being pushed toward illicit private loans. In particular, moneylenders, often the last resort for borrowers, have stopped or reduced new lending due to legal maximum interest rate restrictions, raising the threshold for those needing quick cash.

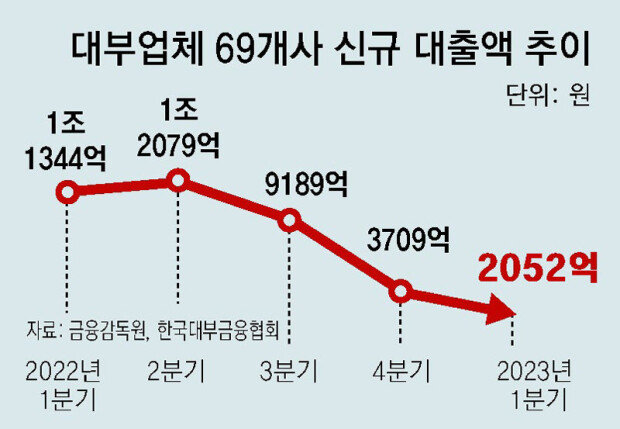

According to data that the office of Oh Ki-hyung, a Democratic Party lawmaker of the National Assembly’s National Policy Committee, obtained from the Financial Supervisory Service, new loans from 69 licensed lenders plunged from 1.1344 trillion won in the first quarter of last year to 205.2 billion won in the first quarter of this year. That's a whopping 81.9 percent drop in just one year. The number of people who took out new loans also dropped from 91,024 to 26,767 over the same period. The average loan amount per capita also dropped from 12.46 million won to around 7.67 million won.

This is because lenders have been suspending or reducing new lending since the second half of last year, when procurement interest rates rose sharply. Lenders generally borrow money from savings banks and capital firms, or issue corporate bonds to finance their loans, of which the procurement rates have now risen to 8 to 10 percent. Considering personnel and advertising expenses, it's virtually impossible to make a profit even if you lend at the legal maximum of 20 percent, according to the industry.

“The number of loans to low-income self-employed individuals has rapidly increased due to COVID-19," said Jeon Seong-in, a professor at the School of Economics of Hongik University. “The financial authorities should screen vulnerable borrowers and be more active in adjusting their debts.”

mjlight@donga.com · 1am@donga.com