Won-dollar exchange breaks through 1,400 won after Fed’s third giant step

Won-dollar exchange breaks through 1,400 won after Fed’s third giant step

Posted September. 23, 2022 07:51,

Updated September. 23, 2022 07:51

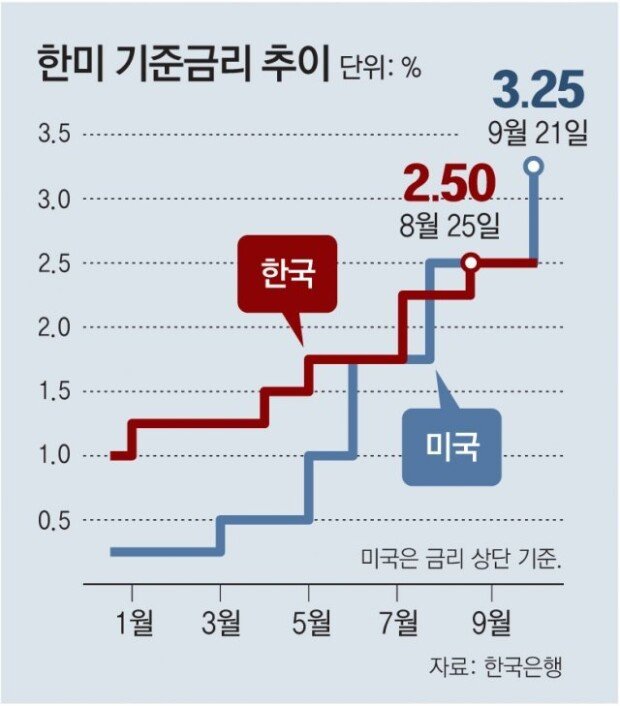

The U.S. Fed took another giant step by raising its benchmark interest rate by 0.75 percentage points three months in a row, following June and July. The key interest rate of the U.S. increased to 3.0 to 3.25 percent, hovering way above Korea’s 2.5 percent. The reversal of the interest rate gap between the U.S. and Korea, which increased the likelihood of foreign capital flow, combined with the continuing uncertainty of the Korea-U.S. currency swap agreement, which was expected during the Korea-U.S. summit, drove up the won-dollar exchange rate to over 1,400 won.

The Fed’s rate hike to its highest level in 14 years and eight months arose from its judgment that the U.S. inflation that rose to the 8 percent range needs to be constrained, even supposing that the rate hike may precipitate an economic recession. Jerome Powell, the Fed chair, sternly stated that the Fed would not consider dropping the interest rate until it is extremely sure that inflation is going down to its target rate of 2 percent. The Fed will deliver more rate hikes in two more meetings left this year until the interest rate reaches the mid-4 percentage range by the end of the year.

Although the rate hike was expected, Korea’s foreign exchange market was hit hard, mostly due to the stalled currency swap agreement with the U.S., which did not go beyond a theoretical agreement reaffirming close cooperation in providing liquidity supply for financial stability. This fell way short of the market’s expectation that President Yoon and President Biden would extensively cover the topic of currency swap at the South Korea-U.S. summit. As a result, the won-dollar exchange rate broke through 1,400 won in 13 years and six months since the global financial crisis.

The Bank of Korea also needs to take urgent action. BOK Governor Lee Chang-yong said that the prerequisite for the rate hike of 0.25 percentage points is no longer valid, forewarning a big step of a rate hike of 0.5 percentage points in October. As the U.S. is expected to increase the benchmark interest rate above 4 percent, the BOK has also accommodated its stance and reversed its previous position of a gradual increase of 0.25 percentage points. Mr. Lee used to highlight a low likelihood that a rapid increase in the exchange rate would leave South Korea in a precarious position. Still, a wide reversal in interest rate differential is making the foreign capital outflow and the rise in import prices more realistic concerns.

The strong dollar will also persist, as the Fed has demonstrated its will to keep continuing rate hikes next year. Countries worldwide are waging a reverse currency war to lower exchange rates and control the rise in import prices by raising interest rates. South Korea, where household debt has reached a dangerous level among the major countries, has no option but to keep pace with the U.S. and speed up rate hikes. The South Korean government and the central bank must stop saying “don’t worry” and produce tangible achievements by, for example, concluding a currency swap agreement and stabilizing the foreign exchange market.

Min-Woo Park minwoo@donga.com