Korea-US inflation slows down

Korea-US inflation slows down

Posted August. 13, 2022 07:27,

Updated August. 13, 2022 07:27

There are signs that the trend of global inflation, including Korea, is slowing down. Some analysts say that inflation has peaked, but there are also many cautious views that it is still too early to make a conclusion.

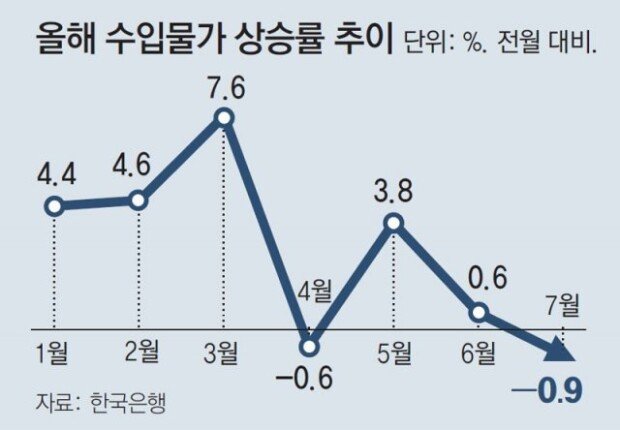

According to the Bank of Korea on Friday, the import price index for last month was 153.49, down 0.9 percent from June. Import prices continued to rise (4.4 percent) from January of this year, before briefly decreasing in April (-0.6 percent), and then continued to go up again in May and June.

The main reason for the decline in import prices despite the rise in the won-dollar exchange rate was the fall in international oil prices. The price of Dubai crude fell 8.9 percent from an average of 113.27 U.S. dollars per barrel in June to 103.14 dollars per barrel in July. Due to the drop in oil prices, raw material prices such as mining products and agricultural, forestry and fishery products fell 2.6 percent, and intermediate goods prices such as coal and petroleum products fell 0.2 percent, respectively. The decline in import prices is reflected in the overall consumer price with a time lag.

The U.S. inflation has slowed as well. The U.S. producer price index (PPI), released on Thursday (local time), fell 0.5 percent from the previous month, and it is the first time in more than two years that the PPI slid compared to the previous month since April 2020 (-1.3 percent) at the beginning of the pandemic. Compared to the same month of the previous year, the PPI rose only 9.8 percent, where the rate of increase fell below 10 percent for the first time since January of this year. The U.S. announced on the previous day that the Consumer Price Index (CPI) for July fell to 8.5 percent from the previous month (9.1 percent).

If the U.S. inflation begins to slow in earnest, its central bank, the Federal Reserve, has room to slow down the pace of benchmark rate hikes. This could put the brakes on the appreciating dollar and lower Korea's import prices further. Even within the Fed, however, many are sounding the alarm that inflation monitoring should not stop.

speakup@donga.com

Headline News

- Med professors announce intention to leave hospitals starting Thursday

- Bridge honoring Sgt. Moon Jae-sik unveiled in Pennsylvania

- Chief of Staff Chung tells presidential secretaries to stay away from politics

- US FTC bans noncompete agreements

- N. Korea launches cyberattacks on S. Korea's defense companies