By Anna Fifield in Seoul and Chris Giles in London

Published: May 18 2005 19:14 | Last updated: May 19 2005 05:12

South Korea's central bank will not intervene any further in foreign exchange markets, the governor of the Bank of Korea said on Wednesday in comments likely to unsettle financial markets.

"I believe that we now have sufficient reserves to secure our sovereign credibility, so I do not anticipate increasing the amount of foreign reserves further," Park Seung told the Financial Times. South Korea's foreign currency reserves stand at $206bn the fourth largest in the world.

Mr Park said: "We now need to take more consideration of profitability, and I think we're at a stage where we need to manage our reserves in a more useful way."

Although he made no explicit comment on the won, Mr Park's remarks imply that South Korea is now unwilling to undertake the intervention required to stem its currency's rise.

The central bank has spent billions of dollars in the foreign exchange markets to contain the won.

Nevertheless, he won has appreciated by 30 per cent against the US dollar over the past three years, 17 per cent of that in the past year alone, making it the world's fastest rising currency.

His comments mark a change of stance since February, when he told Central Banking, the quarterly journal: "It is very difficult to evaluate whether the current level of our international reserves is adequate or not."

He said at the time that it would be difficult for South Korea's economy to shoulder the burden of a strong appreciation of the won.

The change of stance will have implications both in South Korea where a rising won will further erode exporters' margins and in the US, where it could hit demand for Treasuries and other dollar-denominated assets.

Mr Park said he did not envisage changing the currency mix of the reserves, about two-thirds of which is thought to be in dollar-denominated assets. In February the dollar recorded its biggest drop in five months when a Bank of Korea report said it would diversify its foreign exchange reserves.

With Japan, China and South Korea which together hold at least a third of the world's central bank foreign exchange reserves each likely to suffer if one moves first to lessen their exposure to the dollar, some economists believe there is scope for more regional co-operation.

Mr Park said: "I think that the economic co-operation of these three nations and the co-operation of their central banks is necessary to promote the growth and development of the global economy."

But the banks were working together only to maintain financial stability and were not doing anything that might "affect" international markets, he said.

The US Treasury on Tuesday signalled that it expected China to revalue its currency within six months. Mr Park said: "I think that is China's job 「but」 China is smart enough to deal with this issue to help adjust the imbalances within the global economy and stabilise the regional economy." Of greater concern were the US's current account and budget deficits, which Asian central banks have largely been funding. "They 「the deficits」 will aggravate the global imbalances and undermine global economic growth," Mr Park said.

"I think there is a need for the US to dissolve these twin deficits for the benefit of the US economy, the world economy and the Korean economy."

The dollar moved lower on foreign currency markets on Wednesday afternoon, as the FT report of Mr Park's remarks emerged. )

-

- 좋아요

- 0개

-

- 슬퍼요

- 0개

-

- 화나요

- 0개

-

- 추천해요

- 개

지금 뜨는 뉴스

-

“안 다쳤다”더니 ‘휘청’…이상 증세 감지한 경찰이 목숨 구해

- 좋아요 개

- 코멘트 개

-

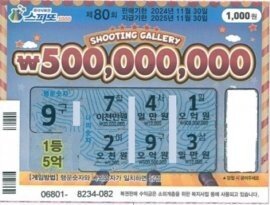

1천원 당첨된 줄 알고 넘겼는데…자세히 보니 1등

- 좋아요 개

- 코멘트 개

-

4·19 ‘도둑 참배’ 조국 비판에 대통령실 “자기애 과하다”

- 좋아요 개

- 코멘트 개

댓글 0