Global players in M&A binge in fast-growing food delivery app market

Global players in M&A binge in fast-growing food delivery app market

Posted January. 04, 2020 07:52,

Updated January. 04, 2020 07:52

Korea’s largest food delivery app “Baedal Minjok” was taken over by Germany’s Delivery Hero (DH) on December 13, last year. The app was sold for 4 billion U.S. dollars. Attention is increasing on the food delivery app industry in different countries due to hefty values that go beyond imagination.

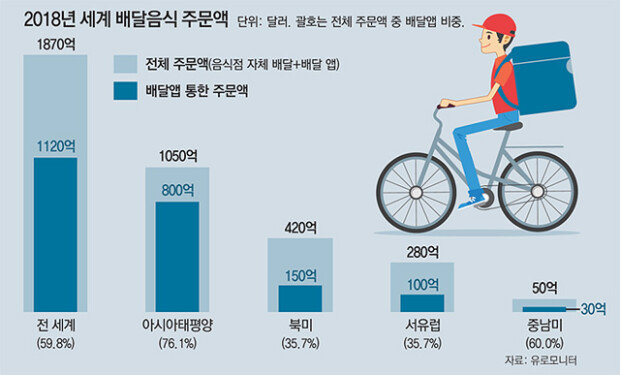

The food delivery app industry is expanding robustly due to a growing number of single-member households as well as widespread smartphones. Citing consulting firm Forest & Sullivan’s report, the U.S. business magazine Fortune predicts the global food delivery app market, which was worth 82 billion dollars in 2018, will grow to reach 200 billion dollars in 2025. The conventional food delivery market based on telephone was only limited to specific types of foods including fast food and Chinese food. However, Forbes’ analysis suggests that the food delivery app market has expanded the number of restaurants in service to thousands and that of menus to millions. The industry has achieved phenomenal growth by widening choices to a generation familiar with smartphones. The New York Times reported that by 2030, almost all people worldwide will eat meals by using food delivery apps rather than cooking home.

Companies are scrambling in a race to gain the upper hand in the industry as well. The European and North America markets where no single firm is currently dominating are effectively in a state of war between players. Amazon, which established “Amazon UK” in 2016 before closing the online shopping mall two years later, has invested 575 million dollars in U.K. food delivery app Deliveroo in a bid to make a foray into the U.K. market. Originally, the U.S. e-commerce giant intended to take over Deliveroo, but changed its course to stake investment in lieu of takeover in the face of London’s objection.

Meanwhile, “Takeaway” of the Netherlands and “Naspers” of South Africa, which is majority stakeholder in DH, are competing to take over “Just Eat” of the U.K. “Takeaway,” the No. 1 player in East Europe, acquired the German operation of DH for 1.1 billion dollars in 2018. “Takeaway” definitely needs “Just Eat” to advance into West Europe and North America as it is competing with “Uber Eats,” a subsidiary of the U.S. car-sharing firm Uber, in Europe, Canada and Australia, to become No. 1 player in the food delivery app sector. “Naspers” is also aiming to enter these markets. The two rivals are staging a do-or-die battle to acquire “Just Eat” by raising their offering prices.

The Chinese food delivery app market, amounting to 34 billion dollars as of 2018, is the single largest market in the world. Two companies backed by IT giants are staging fierce competition in this market as well. Meituan Dianping, backed by Tencent, and Ele.me, invested by Alibaba, saw their combined number of orders exceed 10 billion in 2018.

On the other hand, poor working conditions of ‘platform workers’ are one of the key challenges that food delivery apps in different countries have to address. Platform workers, who are working on digital platforms including social media and apps, are in ambiguous employment status as they are considered neither self-employed nor salaried workers. Moreover, the exorbitant gap in wealth between platform workers and owners has emerged as a major social issue in different countries.

In the wake of rapid growth of food delivery apps, smaller merchants in communities are suffering amid harsh business conditions, while platform-based conglomerates are less enthusiastic about making social contributions to the community than conventional conglomerates, which is another problem. Neighborhood mom and pop restaurants are facing falling profit due to food delivery apps, and Millennials are killing smaller restaurants, The New York Times reported. The UK daily Guardian said, “Food delivery apps fuel a junk economy.”

jyr0101@donga.com

Headline News

- N. Korea launches cyberattacks on S. Korea's defense companies

- Major university hospital professors consider a day off each week

- Italy suffers from fiscal deficits from ‘Super Bonus’ scheme

- Inter Milan secures 20th Serie A title, surpassing AC Milan

- Ruling and opposition prioritize spending amid tax revenue shortfalls